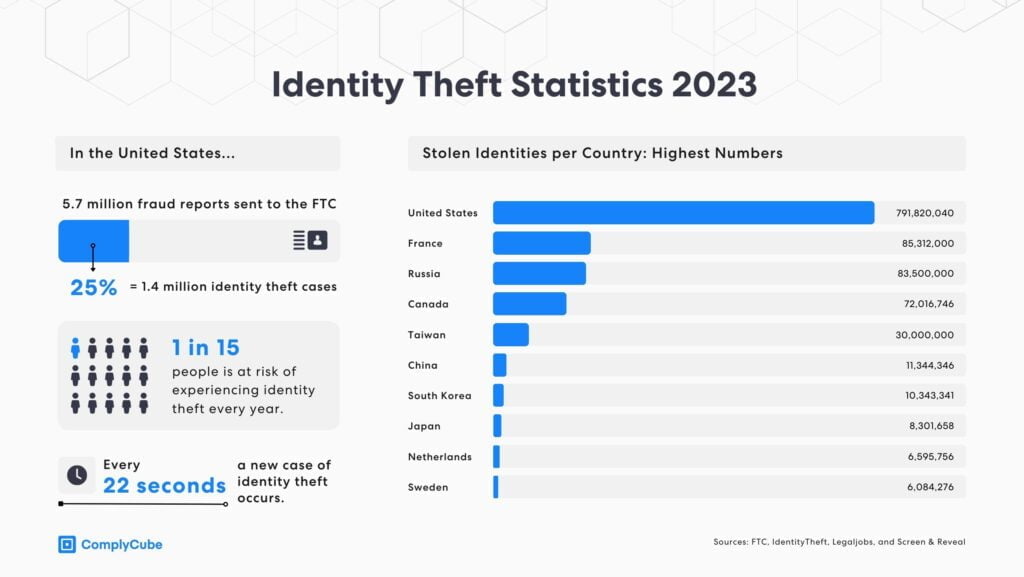

Identity fraud involves either stealing or creating an identity for fraudulent gain. The Bureau of Justice Statistics in the US states that, in 2021, 23.9 million US residents aged 16 or older fell victim to identity theft of some type. In the UK, the Fraud, Identity, and Digital Banking Consumer Survey for 2023 from FICO revealed that 1.9 million British consumers fell victim to financial account misuse. Without the implementation of robust identity verification processes, including biometric verification that leverages liveness detection, digital platform users are at risk of identity fraud. With digital strategies becoming increasingly complex, identity fraud poses potentially devastating losses to any business, consumer, or even government organization.

What is Identity Fraud?

Bad actors can commit identity fraud by either stealing or creating an identity for personal gain. Identity theft is the unauthorized use of a person’s sensitive information, such as Social Security numbers, names, addresses, or other personal information, such as bank details. Fraudsters obtain this personally identifiable information and use it for illegal activity, financial gain, or to sell it on the dark web so others can do the same.

Victims of identity theft often experience financial theft, account takeovers, and stolen identities. Identity thieves then use this information to open accounts or credit cards or apply for loans with financial institutions or digital services without the intention of repayment. Some may even use it to apply for employment or for evidence of Right to Rent. For more on Right to Rent fraud, read “UK DIATF-Certified Right to Rent Checks.”

How Does Identity Theft Take Place?

Numerous strategies exist for obtaining fraudulent identities. Utilizing stolen information, bad actors can then open new accounts by applying directly for credit using that data. However, gone are the days when theft required physically stealing a person’s actual driver’s license or other government-issued credentials. Instead, they need just one piece of data, such as a Social Security number, around which they can build a full identity with fictional attributes. This process, which consists of building a synthetic identity, is one of today’s fastest-growing and hardest-to-detect threats for businesses in most sectors.

An estimated 3 million high-risk identities could be circulating in the UK alone right now.

An estimated 3 million high-risk identities could be circulating in the UK alone right now. With blended accurate and inaccurate details, these identities simulate authentic and credible credit history, making them challenging to detect.

A Global Problem with Expanding Risks

Numerous regulatory bodies and government efforts aim to reduce the risks associated with identity theft. CIFAS, a non-profit organization, continues to shed light on these risks through educational resources. Members of CIFAS report fraud and risk in an effort to collaborate and reduce fraudulent activities. The National Crime Agency (NCA) reports fraud accounts for 40% of crime in England and Wales, four-fifths of which are cyber-enabled, pointing to the issue of digital enablement. The NCA works to pursue fraudsters through public, private, and third-party sectors.

In the US, various organizations aim to educate and combat such efforts, including the Federal Trade Commission, which provides businesses and consumers with a step-by-step recovery plan. The Internal Revenue Service (IRS) and the Social Security Administration (SSA) continue to adopt increasingly robust strategies to mitigate risks within their organizations.

These organizations aim to reduce and control identity theft and stop it from occurring at such a rapid pace. Yet, each individual company and consumer must play their role in mitigating this risk as they stand to lose the most in such events. It’s, therefore, critical that businesses have the necessary KYC processes in place to verify whether customers and users are who they claim to be. The only way to do this securely is to leverage state-of-the-art technologies such as biometric verification and liveness detection.

Identity Fraud in Banking

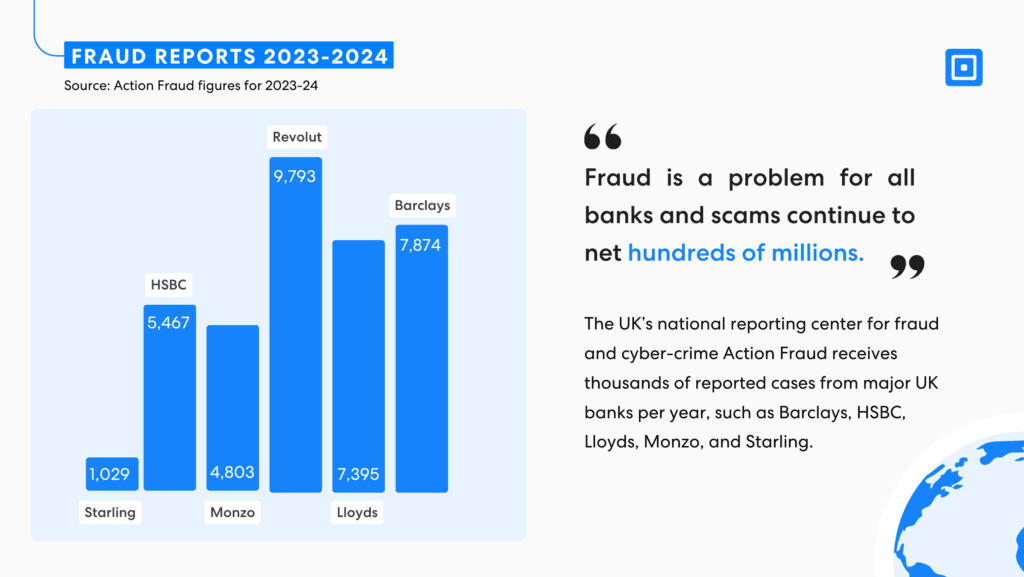

One sector most significantly impacted by ID theft is the finance sector, specifically the banking sector. In the UK, ID theft grew by 14% in 2023, with criminals targeting consumers directly. Yet another high-risk area focuses heavily on the opening of bank accounts and banking services. With nearly 2 million Brits suffering fraud through the opening of new accounts in their name in 2023, this is a growing and concerning problem.

73% of consumers looking to open a new account rated fraud protection strategies as one of their top priorities in the organization they select.

Such activities create noteworthy reputational damage within sectors. Data from FICO research shows that 73% of consumers looking to open a new account rated fraud protection strategies as one of their top priorities in the organization they select. However, one in five consumers will abandon the opening of a bank account when identity checks are time-consuming or too difficult. This demonstrates the incredible importance of finding balance.

How Are Regulators Protecting Businesses and Consumers?

The Financial Services and Markets Act (FSMA) was introduced in the UK in 2000, long before such digital identity theft risks existed. Over time, increased strategies aim to strengthen this premise. Specifically, the UK financial regulatory framework from the Financial Conduct Authority (FCA) and Prudential Regulation Authority (PRA) aims to mitigate risks. The Know Your Customer (KYC) and Anti-Money Laundering (AML) efforts are at the heart of this. As a watchdog for consumers, FCA and PRA face an uphill battle as fraudsters quickly overcome defense strategies.

Why Do Regulators Induce Regulations to Combat Identity Fraud?

Reducing identity fraud has true value for global economies, businesses, and individuals alike. Regulation offers protection and a stable framework for businesses to grow securely. Regulators aim to achieve this by applying and adopting increasingly robust strategies:

- Financial losses: Identity theft leads to significant financial losses for both consumers and businesses.

- Customer protection: Regulations aim to safeguard consumer personal information. Strategies are in place to protect consumers from unauthorized access and misuse. Without such strategies, the risk of financial devastation and the inability to prove losses is increasingly challenging.

- Public trust: Another fallout from identity theft risks is irreparable damage to an institution’s reputation. The regulatory framework clarifies the organization’s focus on minimizing risks and building public trust with customers and stakeholders.

- Limit criminal activity: Fraudsters use this information to commit crimes, often exploiting the most vulnerable of victims to years of financial loss and difficulty. On a much grander scale, regulators aim to apply rules that minimize money laundering and terrorism-related activities, which could be directly funded through such gaps.

- Facilitate fair competition: Standards ensure that all organizations have the same requirements and a level playing field. This can help with compliance-related matters that lead to an unfair advantage, such as by creating lax security.

Biometric Systems For Effective Fraud Prevention

The FCA’s efforts for identity theft prevention are notable. Their handbook provides good practice examples or steps organizations can take to mitigate risks associated with identification risk. That includes, for example, using electronic verification checks or PEP databases to verify identities. It may also mean creating strategies that meet the needs of consumers who may not have common forms readily available. Firms must work consistently to protect customers and stakeholders through robust—and ever-increasing—strategies that ensure identification is made thoroughly and authentically.

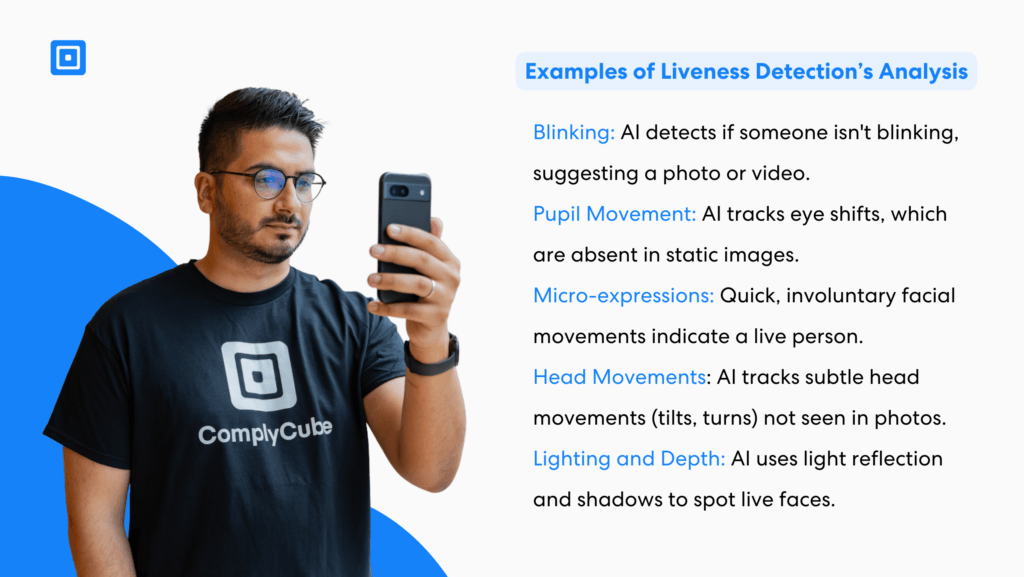

An additional layer of protection using biometric information could be even more important. A user’s biometrics are very difficult for fraudsters to falsify. Other strategies that could facilitate improved ability to verify identity online include biometric data verification, such as biometric identification through a robust authentication process.

KYC with Expert Identity Checks

There’s still value to passive biometric verification. It is convenient, scalable, and frictionless, improving customer experience. These are key customer retention strategies for nearly all fintech companies. For those in digital services, the passive liveness detection technology provides numerous benefits:

1. Seamless User Experience

Automated checks are much faster than outdated manual processes, as well as being far more accurate. Businesses can decide between passive and active identity checks, which require more or less intervention from the end user. Passive identity verification checks are conducted in the background and don’t require any action from users, which benefits organizations that are worried about interference with customer experience from incorporating sophisticated checks. However, active checks offer the highest possible level of security, leveraging sophisticated liveness detection and biometric technology, ensuring accuracy at all times.

2. Reduced Drop-Off Rates

The reduction in friction minimizes the risk that customers will pause and not come back to the onboarding and verification process. This leads to fewer abandoned sign-ups or online transactions for individuals, satisfying more customers. Online identity verification is a critical component for organizations offering services on a mobile device, and a reliable but fast verification process is needed.

3. Scalability for High Transaction Volumes

Passive systems can navigate larger user groups simultaneously without demanding users to engage in more laborious tasks. As a fintech platform scales operations, they are more cost-effective. They can onboard new customers quickly, ensuring compliance and minimizing presentation attacks and other fraudulent activities across numerous people at one time. Incorporating these checks, therefore, empowers organizations to scale quickly and seamlessly, allowing for secure growth and powering global economies.

Behavioral biometrics (like analyzing patterns of typing or device navigation) can passively monitor online banking sessions for fraud while enhancing user experience by maintaining seamless transitions between tasks. More elaborate methods, such as voice recognition and facial recognition, enable organizations to capture customers’ likenesses against previous data. This can happen within seconds, providing quick access to apps and tools.

Utilization of the Biometric Check: A Critical Move Forward as an Identity Verification Method

Biometrics, where active identity verification is used for the most robust and sensitive transactions, or passive identity verification is used for large-scale results, can create a far more advanced and effective level of security for companies throughout the fintech industry.

ComplyCube offers biometric check solutions that are leading the way from face recognition to behavioral biometrics. Designed to provide both active and passive strategies, including cutting-edge liveness detection, ComplyCube enables fintech companies to meet customer experience needs with compliance requirements and fraud reduction.

For more information on ComplyCube’s services, reach out to their expert compliance team.