Electronic Identity Verification tools have become a common solution for Know Your Customer (KYC) practices. Combining a robust online document checker and biometric Identity Verification (IDV) powered by state-of-the-art Artificial Intelligence (AI), IDV solutions are pillars of modern compliance.

However, there is a wide variety of providers to choose from for such an important compliance process. This guide examines the traits to look for when choosing an Identity Service Provider (IDSP), as well as the benefits of integrating with an IDV solution.

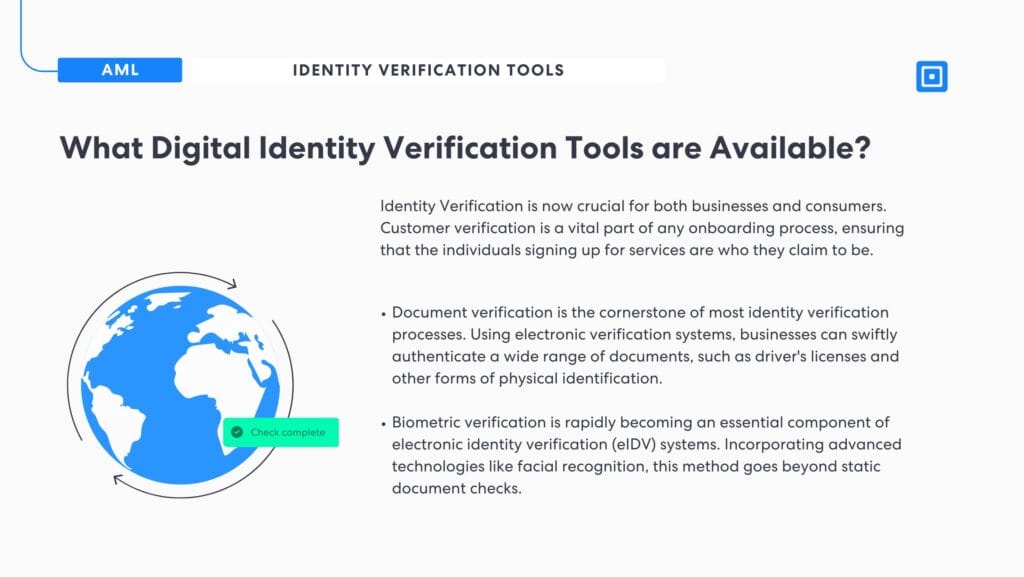

What Digital Identity Verification Tools are Available?

Identity Verification is now crucial for both businesses and consumers. Customer verification is a vital part of any onboarding process, ensuring that the individuals signing up for services are who they claim to be.

Identity verification is a critical safeguard in the digital age, serving as a primary defence against fraud and ensuring that only genuine customers access services.

Digital identity verification tools are designed to streamline the customer onboarding process while mitigating fraud risks. These tools range from document authentication to sophisticated biometric verification and other fraud detection mechanisms. By integrating these tools into your compliance framework, institutions significantly reduce the risk of fraudulent activity while improving user experience.

Document Verification

Document verification is the cornerstone of most identity verification processes. Using electronic verification systems, businesses can swiftly authenticate a wide range of documents, such as driver’s licenses and other forms of physical identification.

By automating this part of the process, companies not only speed up verification times but also increase accuracy, protecting themselves from potential identity fraud. For more on how digital document verification fortifies eKYC, read “Digital Document Verification and eKYC.”

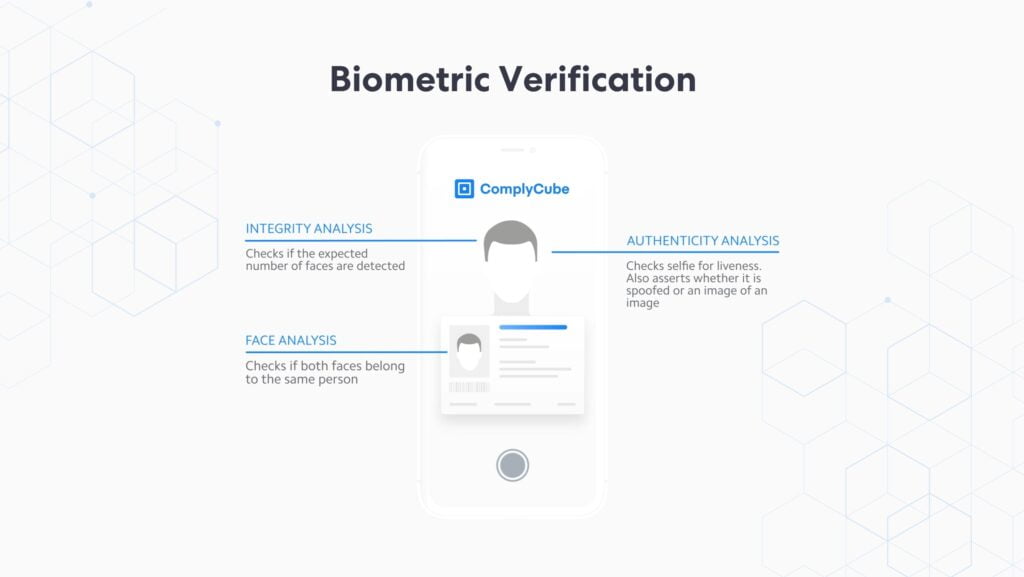

Biometric Verification

Biometric verification is rapidly becoming an essential component of electronic identity verification (eIDV) systems. Incorporating advanced technologies like facial recognition, this method goes beyond static document checks.

For adequate Anti-Money Laundering (AML) compliance, biometric verification provides an added layer of security by ensuring that the person submitting the documents is the rightful owner. Liveness detection features, which verify whether a person is physically present during the identity check, further enhance the security of these systems, preventing identity spoofing or other forms of fraud. To learn more about the advantages of biometric verification, read “The Advantages of Biometric Authentication.”

Enhanced Identity Verification

Companies must adopt enhanced identity verification techniques as fraud schemes grow more sophisticated. This involves going beyond basic document and biometric checks to validate customer identities using multiple layers of due diligence processes.

Enhanced verification typically includes scrutinizing the customer’s digital footprint and comparing data across various trusted sources to ensure a comprehensive assessment. By investing in enhanced identity verification solutions, businesses can better protect themselves from high-risk users, including fraudsters and money launderers.

Proof of Address Verification

Proof of address is another critical aspect of identity verification. With eIDV solutions, verifying a customer’s address is streamlined through cross-checks against private databases and public records.

This approach helps eliminate the need for manual submission of utility bills or bank statements, speeding up the verification process while maintaining a high level of accuracy. A reliable proof of address system enhances the integrity of your customer records and reduces the chances of address-related fraud.

Age Estimation

In some industries, age verification is essential, particularly for services that have age restrictions. Age estimation technology can help businesses comply with legal requirements without causing friction in the onboarding process. By using AI-powered analysis, businesses can quickly estimate a customer’s age, adding an extra layer of compliance and protection for both the company and the end-user.

The Benefits of Online Identity Verification Tools

The advantage of these systems lies in their ability to instantly cross-reference details against multiple databases, making it easy to spot discrepancies in the extracted data. Using key AML checks alongside Electronic Identity Verification (eIDV), digital compliance solutions create a swifter onboarding process, screening for Politically Exposed Persons (PEPs) and appearances in adverse media, alongside other metrics.

- Multi-bureau screening

- Politically Exposed Person (PEP) screening

- Adverse media checks

- Sanctions and watchlist screening

- Other AML checks

Streamlining the customer identity verification process is essential for businesses that aim to stay competitive while keeping verification costs manageable. By leveraging advanced Identity Verification tools, financial institutions, and other regulated entities can ensure they are not only compliant but also safeguarding customer data.

Ultimately, this contributes to enhanced fraud prevention controls, reducing the risk of identity theft and fraud across the board. The ability to verify identity accurately and quickly is no longer a luxury—it’s a necessity for businesses looking to build trust with their customers. Effective verification also ensures that customer information remains secure, a critical factor in today’s data-driven financial landscape.

About ComplyCube’s eIDV solutions

ComplyCube is a leading provider of Electronic Identity Verification (eIDV) solutions, designed to help businesses meet their compliance obligations and protect against fraud. ComplyCube offers a comprehensive suite of tools that combine document verification, biometric identity verification, and advanced Anti-Money Laundering (AML) checks to create a robust, user-friendly, and secure identity verification process.

Choosing ComplyCube as an IDSP

ComplyCube’s market-leading and award-winning compliance solutions can be integrated in a number of ways. Using their user-friendly platform, consumer data can be tracked, exported, and used for compliance decisions easily. Larger firms wishing to integrate only the check and export data to their own platform can integrate it via a powerful API or SDK.

- Compliance: Stay compliant with the latest KYC, AML, and global data protection regulations, including GDPR and eIDAS.

- Fraud Prevention: Advanced fraud detection mechanisms reduce the risk of identity theft and financial crime.

- Speed and Efficiency: Automated processes ensure rapid verification without sacrificing accuracy.

- User-Friendly Experience: Offer your customers a frictionless onboarding experience with instant verification capabilities.

- Security: Protect sensitive customer data with robust encryption and secure data handling protocols.

Reach out to a compliance specialist to learn more about how ComplyCube is building trust at scale.