Document capture for all

Guided document verification

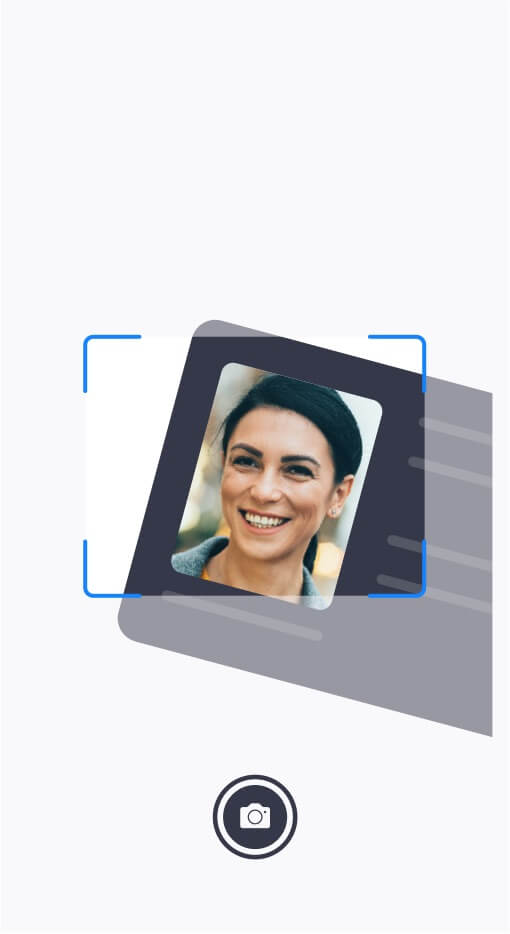

Our services have been designed to be accessible to all. Using our components, you will be able to create user journeys that guide your customers step-by-step for the perfect document capture.

Not only do your customers enjoy a better user experience by using our assisted capture components. But your compliance teams will have fewer false positives to review.