Businesses across every sector are under an increase in pressure to comply with KYC and AML regulatory requirements. These regulations are crucial for protecting businesses from fraud, money laundering, and financial crimes. It’s important for businesses to partner with trusted providers who can ensure compliance on a national and international scale, meaning that companies must be savvy when deciding which provider to choose. Identity verification solutions allow businesses to remain compliant and prevent identity fraud from their platform.

In 2024, the Federal Trade Commission reported 1,135,291 cases of identity theft in the United States, marking an increase of approximately 98,000 cases compared to 2023. However, this rise in sophisticated identity fraud isn’t confined to the US; it’s a growing issue worldwide. A March 2024 study by Synectics revealed that 45% of fraud reported by banks in the UK involved identity theft. In financial terms, identity fraud costs the UK an estimated £1.8 billion annually, while the US faces a staggering $47 billion in losses in 2024.

The Key Features of Identity Verification Solutions

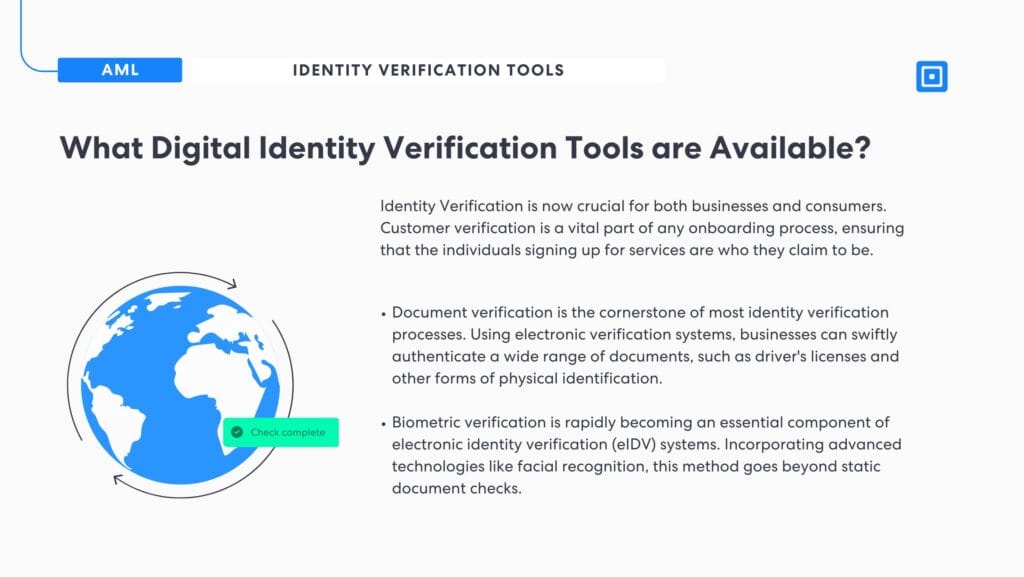

At the heart of every KYC platform is the ability to accurately verify the identity of customers. In addition to traditional document verification, biometric solutions, such as facial recognition, are now needed to fortify operations. Key features that are required for full compliance include:

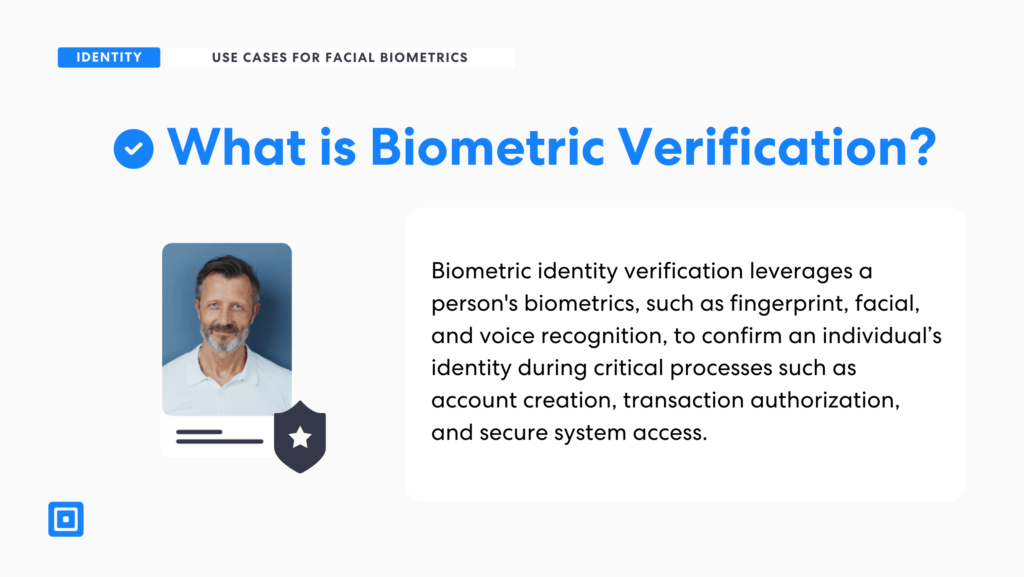

Biometric Facial Verification: Standard identity document checks are no longer enough to ensure fraud prevention and achieve full compliance. An in-depth biometric verification check should be included within your KYC platform. Identity verification solutions can analyse biometric data to verify an identity using AI powered technology.

Liveness Detection Technology: To accurately spot deepfakes, biometric verification must leverage Liveness Detection technology. Liveness Detection is able to quickly identify sophisticated presentation attacks, such as deepfakes or video replays. For more information on presentation attack detection, read “Presentation Attack Detection: A Comprehensive Guide.”

Liveness detection spots deepfakes by analyzing subtle, difficult to replicate human behaviors and characteristics:

- Subtle Micro-Expressions: Real people exhibit unique motion patterns, like blinking, eye movement, and micro-gestures, which deepfakes often fail to replicate accurately.

- Lighting & Texture: Real faces reflect light naturally, with skin textures and wrinkles that deepfakes often get wrong, making them detectable.

- Depth Perception: Liveness systems can detect the 3D structure of a face, which deepfakes struggle to simulate, especially with head movement.

- Audio-Visual Sync: Liveness detection checks if lip movements match speech, identifying mismatches in deepfakes.

- Behavioral Biometrics: Humans respond to challenges like blinking or head turns in ways deepfakes can’t, exposing inconsistencies.

- AI & Machine Learning: Liveness detection uses advanced algorithms to spot patterns that deepfakes can’t replicate accurately in real-time.

If several providers offer these necessary features, a key way to identify which providers have the latest and most accurate technology is checking whether they hold key certifications for their solutions. Some examples include:

ISO-Certified Presentation Attack Detection (PAD) Technology (ISO/IEC 30107-3): This certification marks that the IDV technology can analyze and detect the presence of various types of fraud attempts, such as printed photos, video replay attacks, and more. By building 3D facial maps, it assesses critical aspects like skin texture, micro-expressions, and movement to detect fraudulent attempts and ensure the person is live during the verification. KYC providers that hold this certification are likely to be leveraging cutting-edge technology with liveness detection.

UK Government DIATF-Certified: The DIATF certification, which applies to UK-based providers, specifies standardized confidence levels that IDSPs must meet across different use cases, referred to as profiles. These profiles ensure that the Identity Verification processes align with varying levels of risk and security. To learn more about UK DIATF, read “Choosing a UK DIATF Certified IDSP.”

Finding a provider that holds necessary certifications and is working inline with government expectations for the sector is a great sign that the provider is trustworthy. Transparency around certifications should be upheld by all KYC and AML providers. In addition, looking for trusted sector awards, such as the RegTech 100, can help highlight which providers lead within the market.

Ensuring Both KYC and AML Compliance with Identity Verification Solutions

KYC platforms also play a pivotal role in ensuring that your business complies with Anti-Money Laundering (AML) regulations. Effective AML compliance goes beyond verifying the identity of customers; it also includes screening customers against global watchlists, Politically Exposed Persons (PEP) lists, and sanction lists.

A good KYC provider will offer real-time AML screening to ensure that your business is not inadvertently engaging with high-risk individuals or entities. This capability is essential to minimize the risk of being involved in illicit activities and to maintain a strong reputation. Ongoing monitoring should also be included, with real-time notifications alerting businesses to any risks that may arise.

Other factors that make a KYC platform a top provider are onboarding times, global coverage, customisation and support. Let’s get into what that looks like and what you should look for in your KYC platform.

Fast Yet Secure Onboarding

Speed and accuracy are key in the KYC process. Customers want fast onboarding and a slow verification process will have higher drop off rates. Top KYC platforms give real-time verification so you can verify documents, assess risk and complete the KYC process fast. This not only improves the user experience but reduces operational delays and keeps you ahead of the game.

Onboarding should be short and sweet to avoid high drop off rates. Providers that use cutting edge AI-powered tech can provide secure onboarding with robust KYC in under a minute per customer. Leading KYC providers, such as ComplyCube, can onboard customers in less than a minute with market-leading technology that leverages liveness detection and advanced biometrics.

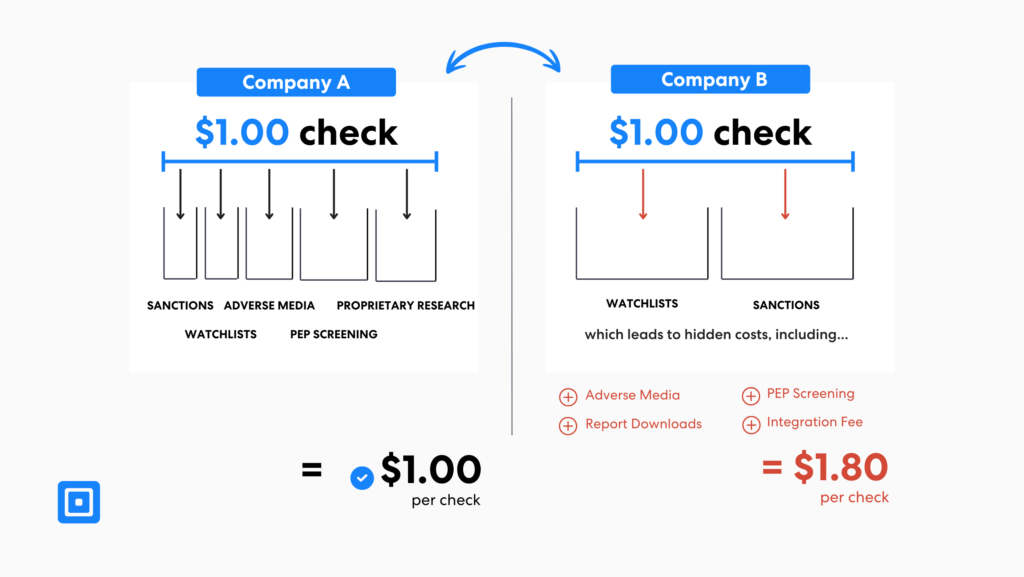

Transparent Pricing

Ensuring that you’re gaining real value from your provider is important, something that is closely tied to transparent pricing. Many AML and KYC providers charge unexpected support fees, or fees required for data retention or report downloads. Fair providers will offer transparent volume-based pricing, with ongoing monitoring included.

From third-party fees to unexpected setup and support costs, these hidden charges can turn what initially seemed like an affordable option into a significant financial burden.

Harry Varatharasan, Chief Product Officer at ComplyCube, states, “Many KYC and AML platforms market their solutions as being highly cost-effective, yet their clients are then caught off guard by hidden expenses that can escalate quickly. From third-party fees to unexpected setup and support costs, these hidden charges can turn what initially seemed like an affordable option into a significant financial burden.” For more on pricing, read “AML Check Cost: Hidden Fees in Compliance.”

Scalability and Customisation within Identity Verification Solutions

As you grow so will your compliance needs. Whether you’re growing your customer base or expanding into new markets the KYC platform you choose should be able to adapt to your changing needs. Scalability is key to your KYC processes staying effective as you get more customers. Customisation is another one. Your KYC platform should be able to offer custom solutions for your industry whether you’re in fintech, e-commerce or cryptocurrency.

Furthermore, the level of verification should be tailored to the potential risk and nature of the business. High-risk sectors, such as finance, may require stringent identity checks due to privacy laws and the sensitivity of the data involved. On the other hand, less-risky businesses, such as subscription-based services or social media platforms, may opt for lighter verification processes that still ensure the integrity of the user base.

Implementing Identity Verification Solutions with ComplyCube

ComplyCube’s platform is built with transparency from the ground up. They provide rich, granular, and clear breakdowns of verification outcomes, enabling compliance professionals to implement risk-based approaches aligned with international standards such as FATF recommendations, the UK’s ICO guidance, and the EU’s AI Act. ComplyCube is also known for providing transparent pricing, a fair platform provides its users with real value. For more information, get in touch with their expert compliance team.