Turkish crypto regulation shifted in 2024, fostering a wave of new AML crypto compliance rules. However, Turkey crypto regulations have a history of vulnerabilities. These vulnerabilities necessitated remedial legislation, such as KYC crypto laws and further cryptocurrency regulations.

This guide examines the state of the Turkish crypto industry, evaluating some of the historic vulnerabilities and digesting the fresh legislation that came to fruition in June 2024.

An Overview of The Turkish Crypto Industry

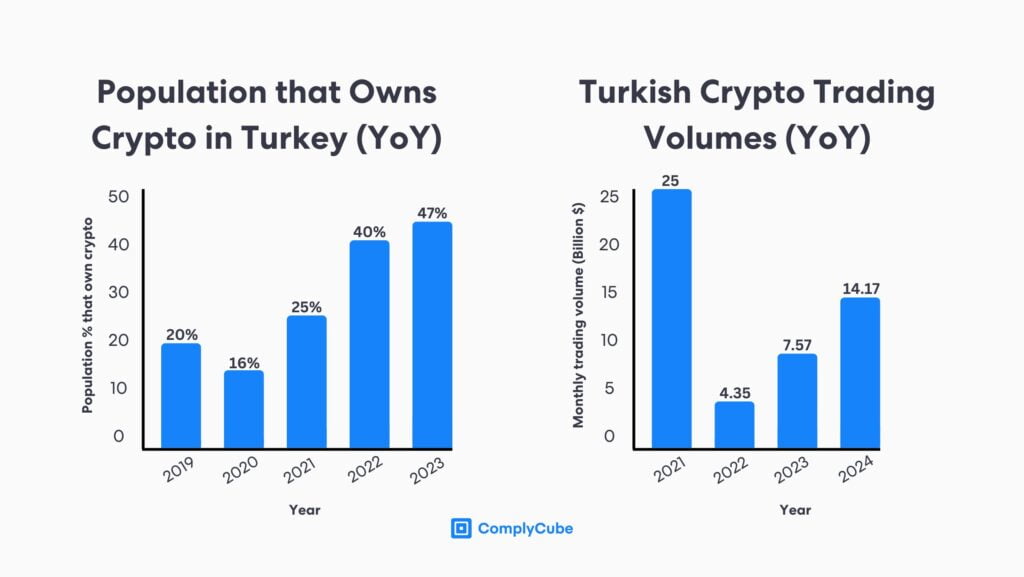

Turkey has rapidly emerged as one of the global leaders in cryptocurrency adoption, driven by a combination of socioeconomic factors. Over the past few years, Turkey has seen a significant surge in crypto adoption, usage, and trading volumes, positioning itself as a major player going forward in the global crypto scene.

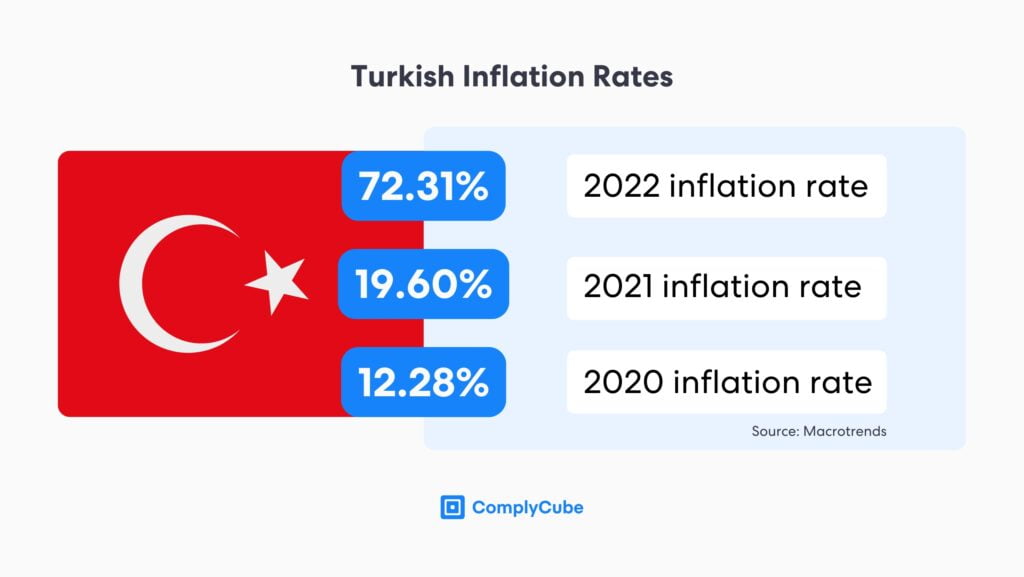

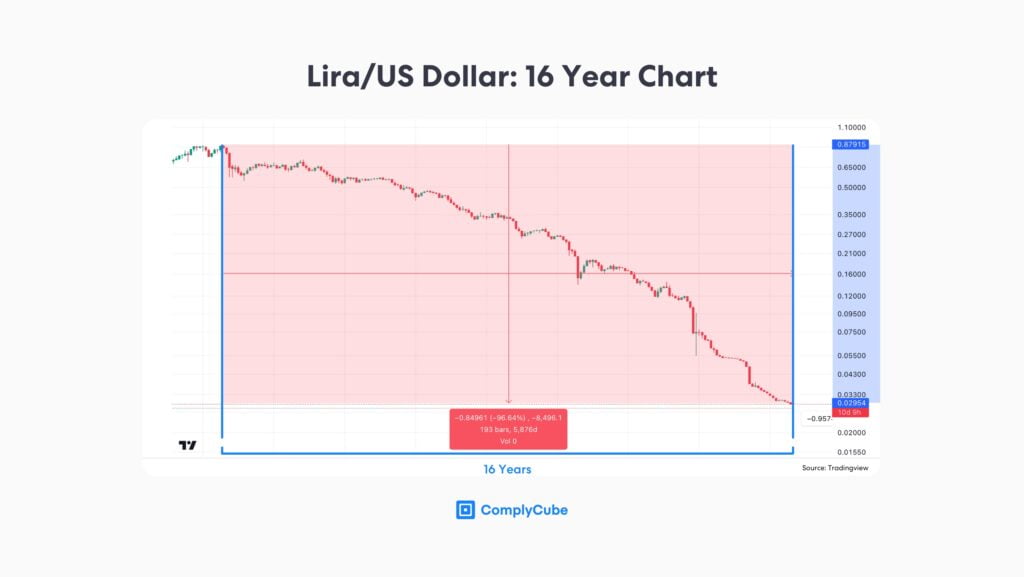

This rise in cryptocurrency adoption can be attributed to several key factors. First and foremost, economic instability has played a crucial role. The Turkish lira is experiencing severe devaluation, with inflation rates soaring to unprecedented heights. Many citizens have turned to digital assets as a hedge against these economic challenges and to protect their wealth.

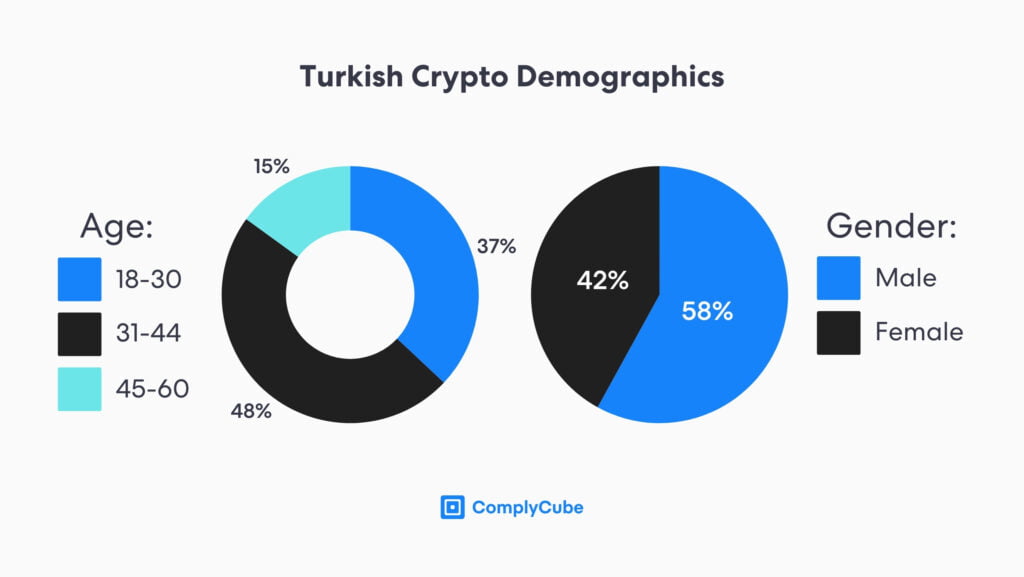

Additionally, Turkey boasts a young, tech-savvy population that is open to embracing new technologies. This demographic is naturally inclined to explore and invest in digital assets, contributing to the country’s high rate of crypto adoption. The appeal of decentralized finance, coupled with the desire for financial autonomy, has further fueled this trend.

As Turkey’s population continued to adopt cryptocurrencies, the country lacked sufficient legislation to facilitate a growing industry safely and securely. Without a robust regulatory framework, it was far too easy to conduct crypto scams and fraudulent activity in the region.

The Thodex Scam

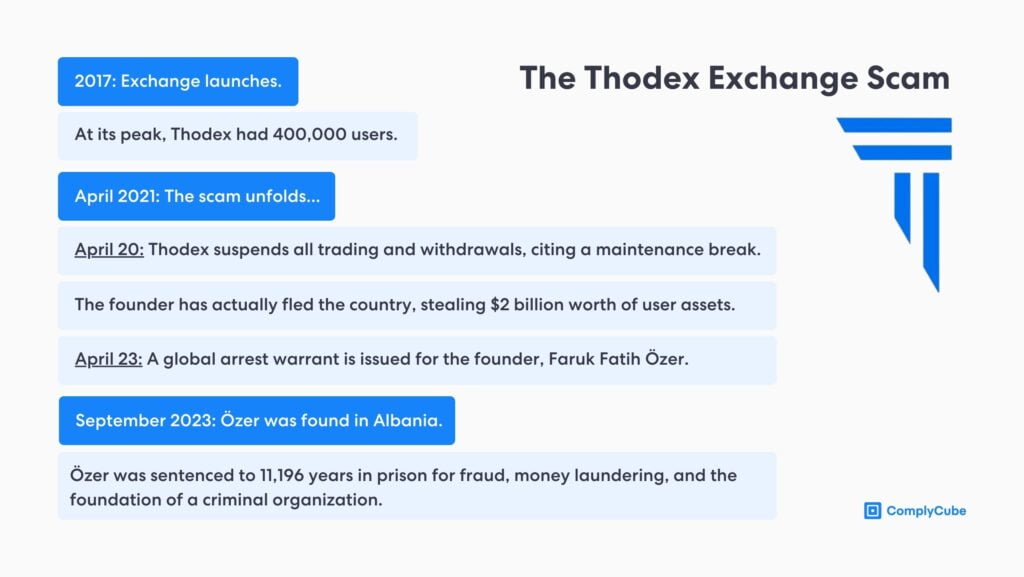

Thodex was a leading Turkish crypto exchange. It used certain marketing strategies to entice users onboard, garnering around 400,000 users in a short period of time. In April 2021, the exchange suddenly stopped all trading and withdrawal operations for its users, ultimately sealing off all funds held by a minimum of 390,000 traders on the exchange.

It was revealed that Faruk Fatih Özer, the 27-year-old CEO and founder of Thodex, had fled the country, reportedly taking with him around $2 billion in investors’ assets. Faruk didn’t escape, however. Turkish authorities swiftly investigated operations at Thodex, issuing an international arrest warrant for him.

In September 2023, he was found in Albania and arrested on charges of fraud, money laundering, and founding a criminal organization. Faruk was sentenced to 11,196 years, acting as a national symbol for the severity of his crimes and setting an example for other crypto criminals.

This scandal exposed critical vulnerabilities in the Turkish crypto industry, leading to a significant upgrade in Turkish crypto legislation. The new regulations introduced in 2024, which include stringent licensing requirements and checks from independent audit firms, are direct responses to the lessons learned from Thodex and represent a significant step forward in securing Turkey’s burgeoning crypto market.

Turkey Crypto Regulations

Following the Thodex exchange scam, government officials have taken serious action to remedy some of the exposed vulnerabilities. However, various laws were put in place around the same time that the scam emerged.

Prohibiting Payments with Crypto Assets (2021)

The Central Bank of Turkey (CBRT) outlawed the use of digital assets as a means of payment, ultimately declaring that cryptocurrencies could not be used as legal tender. This act also barred electronic money institutions from supplying services that could directly or indirectly facilitate crypto payments.

The “Regulation Prohibiting Payments Through Crypto Assets” defined crypto assets as the following.

Intangible assets that are created virtually using distributed ledger technology or similar technologies, distributed over digital networks, and are not qualified as money, registered money, electronic money, payment instruments, security, or any other capital markets instruments.

Such regulation was undertaken due to the anonymity that cryptocurrencies granted. The real concern was that transactions could be miscellaneous, fostering criminal activity and being used as a vehicle for money laundering.

AML Regulations Extended to Digital Assets (2021)

The ‘Regulation on Measures Regarding the Prevention of Laundering Proceeds of Crime and Financing of Terrorism’ was passed on January 1st, 2008, as part of Turkey’s broader efforts in combatting money laundering and terrorist financing. These were to bring the country more in line with the Anti-Money Laundering (AML) recommendations of the Financial Action Task Force (FATF) recommendations.

In May 2021, the regulation was expanded to include the regulation of Crypto Asset Service Providers (CASPs), which were now legally seen as obliged entities. This change was prompted by the growing use of cryptocurrencies in Turkey and the associated risks highlighted by incidents like the Thodex scandal.

2024 Regulatory Updates

2024 has become the year of transformation for Turkey’s cryptocurrency industry, with a comprehensive set of legislation emerging to help stabilize the market.

The Crypto Asset Law (July 2024)

On July 2, 2024, Turkey introduced its most comprehensive crypto regulation. Amending the Capital Markets Law No. 6362, this policy produced a framework for licensing and regulating all CASPs operating in Turkey.

Turkish Crypto Regulations and Licensing Requirements

Any Crypto Asset Service Provider who wishes to operate in Turkey must obtain a license from the Capital Markets Board (CMB). A grace period and deadline for obtaining a license were created to ensure there was sufficient time for organizations to be compliant. The CMB also requires all CASP activities to have a reasonable and economic justification behind them, or else the institution could be subject to penalization.

Titled the Transitional provisions regarding crypto asset service providers, Article 17 of the Amendment Law mandated that a CASP operating license have been obtained by the 2nd of August, 2024, or face penalization.

Since this regulation, major exchanges have ducked out of operations to remain compliant and avoid fines, showing great aptitude for adhering to regulations and playing by the rules. A key example in this is Binance.

Binance, along with 73 other crypto-related businesses, has applied for a CASP license in Turkey, according to the latest news from Turkey’s CMB. Binance has also reduced its marketing presence in the region and has ceased certain Turkish language options in-app.

These developments are significant as they demonstrate a willingness to operate completely legally, compliantly, and above board, something that has been lacking even from major CASPs in recent years. They also demonstrate the significance of the Turkish crypto region as a major area for growth, offering chances of increased revenues from tall trading volumes.

Turkish crypto trading volume totaled $34.9 billion in H1 of 2023, averaging around $70-$75 billion by year-end. According to Chainalysis, 2024’s trading volume is estimated to reach $170 billion for the year. This displays a growth of $100 billion in crypto trading volume YoY and far exceeds a 100% growth rate.

Further CASP Regulations

Due to previous national-scale fraudulent activities, ownership structures of CASPs must be extremely transparent, and new regulations were brought in to ensure this. Partners or senior executives of a Crypto Asset Service Provicer must not:

- Own 10% or more of any financial institution where the operating license has been revoked.

- Be bankrupt and must have the financial strength to operate the business.

- Have a criminal record for property crimes or crimes against the state.

- Be banned under the Capital Markets Law.

- Create a complex ownership structure of the business; the Ultimate Beneficial Owners must be easy to identify.

The Role of TÜBİTAK

As a result of these 2024 amendments, the Scientific and Technological Research Council of Turkey (TÜBİTAK) has a new authority over the Turkish crypto market. Their responsibilities are primarily twofold:

- To establish principles and directives for conducting CASP audits.

- CASP platforms must pay an annual fee (1% of its total annual income) to both the CMB and TÜBİTAK, resulting in a grand total of 2%.

Why is Turkey a Key Region for Crypto?

As this guide has already established, crypto trading volumes continue to skyrocket in Turkey as a direct result of the Country’s economic and inflation crisis. The “Turkish Economic Slowdown” has been in effect since 2018 and has resulted in a severe devaluation of the Turkish Lira.

A currency that cannot maintain its value against other local or international currencies has left many individuals, businesses, and other institutions to flock to crypto assets in an attempt to secure or at least maintain their wealth.

This is a common trend for countries facing hyperinflation, as seen in South American regions such as Argentina, which have historically struggled with high inflation rates. Argentina, alongside Brazil, is a key region in the global cryptocurrency economy.

Just as crypto exchanges critically fought over South American regions for market dominance, the market in Turkey will likely be no different. Crypto asset trading platforms that are looking to compliantly expand into the region must employ swift and accurate onboarding processes to meet the increasing demand for such services.

Crypto AML and Onboarding Processes

Crypto firms or companies supplying infrastructure to facilitate crypto asset transactions must adhere to all of these regulatory demands. This includes the existing Turkish AML legislation that, as of 2021, encompasses the crypto market and that the Financial Crimes Investigation Board of Turkey (MASAK) endorses.

Know Your Customer and Customer Identification

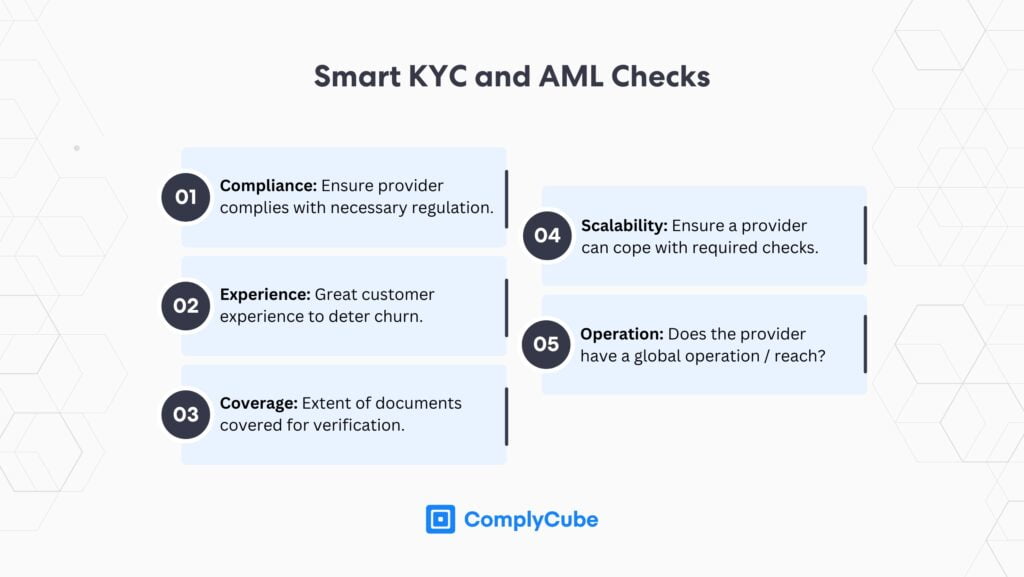

Know Your Customer (KYC) is a vital process for all financial institutions, providing comprehensive details about new users to help mitigate risk and prevent bad actors from abusing your platform or service. Crypto KYC processes include:

- Identity Verification (IDV)

- Customer Due Diligence (CDD)

- Ongoing Monitoring

Crypto KYC and AML processes must go one step further, however, including the monitoring of crypto transactions and further due diligence of various wallets, CASPs, and other financial institutions to adhere to the crypto travel rule. For more information about the FATF’s Recommendation 16, read The Crypto Travel Rule.

ComplyCube’s crypto AML and KYC solution provides comprehensive coverage for CASP compliance in over 220 countries for any digital asset-related service, including crypto asset custody services, exchanges, payment services, and more.

Crypto Expansion Solutions

If your firm or exchange is expanding overseas and looking to remain compliant with new Turkish AML crypto regulations, ComplyCube’s powerful AML and KYC solutions can help. With industry-leading technology, simple integrations, and powerful SDKs and APIs, their crypto compliance solutions are market-leading.

Get in touch with one of their specialists today to learn how they can streamline your onboarding process and ensure you meet rigorous local and overseas regulatory demands.