Many clients and members of our ComplyCube network often ask, “What is name screening in AML?” or “What does name screening even mean?” Others, however, are curious about the ethical challenges associated with name screening, how advanced technology can help overcome these challenges, and the best practices for effective name screening. This guide will explain the name screening process in AML, why it’s essential, and how to incorporate it into your overall risk management and Know Your Customer (KYC) practices.

What Is Name Screening?

Name screening is a subset of the Anti-money Laundering (AML) process. It involves screening the names of individuals, companies, and even countries against various official government databases, such as watchlists, sanctions lists, and lists of Politically Exposed Persons (PEPs). The goal is to identify potential risks related to financial crime, fraud, war crimes, corruption, or terrorism violations. Hence, businesses contribute to a safer financial ecosystem and avoid hefty fines. If you’re interested in understanding why someone might be placed on a sanctions list or want to determine whether a company you’re working with is sanctioned, check out our recent article below.

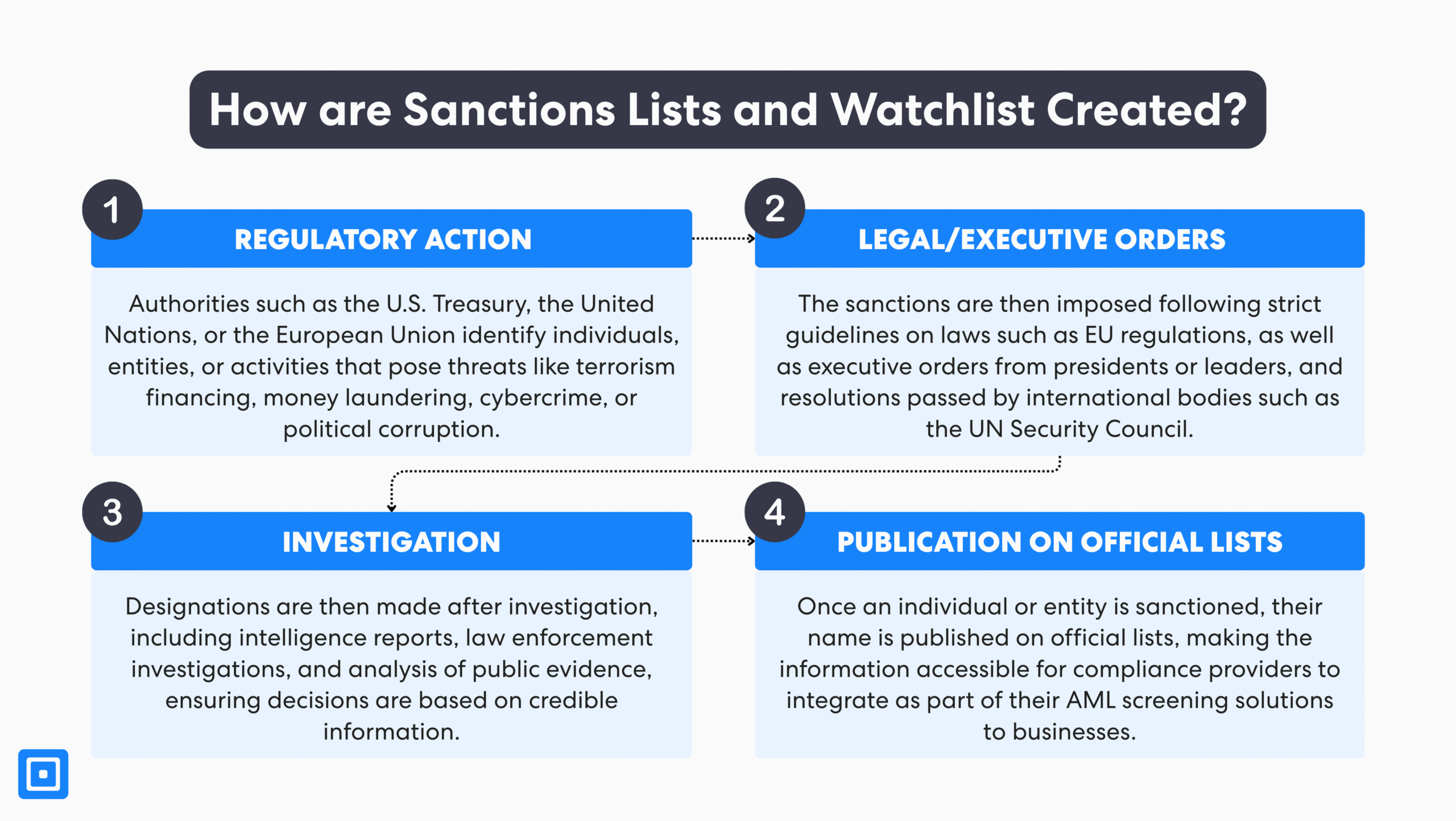

How Are Sanctions Lists and Watchlist Created?

Governments, international organizations and regulatory bodies are responsible for creating and maintaining updated sanctions lists and watchlists. These lists aim to identify and monitor various entities that pose potential risks to national security and financial systems, contributing to effective AML compliance.

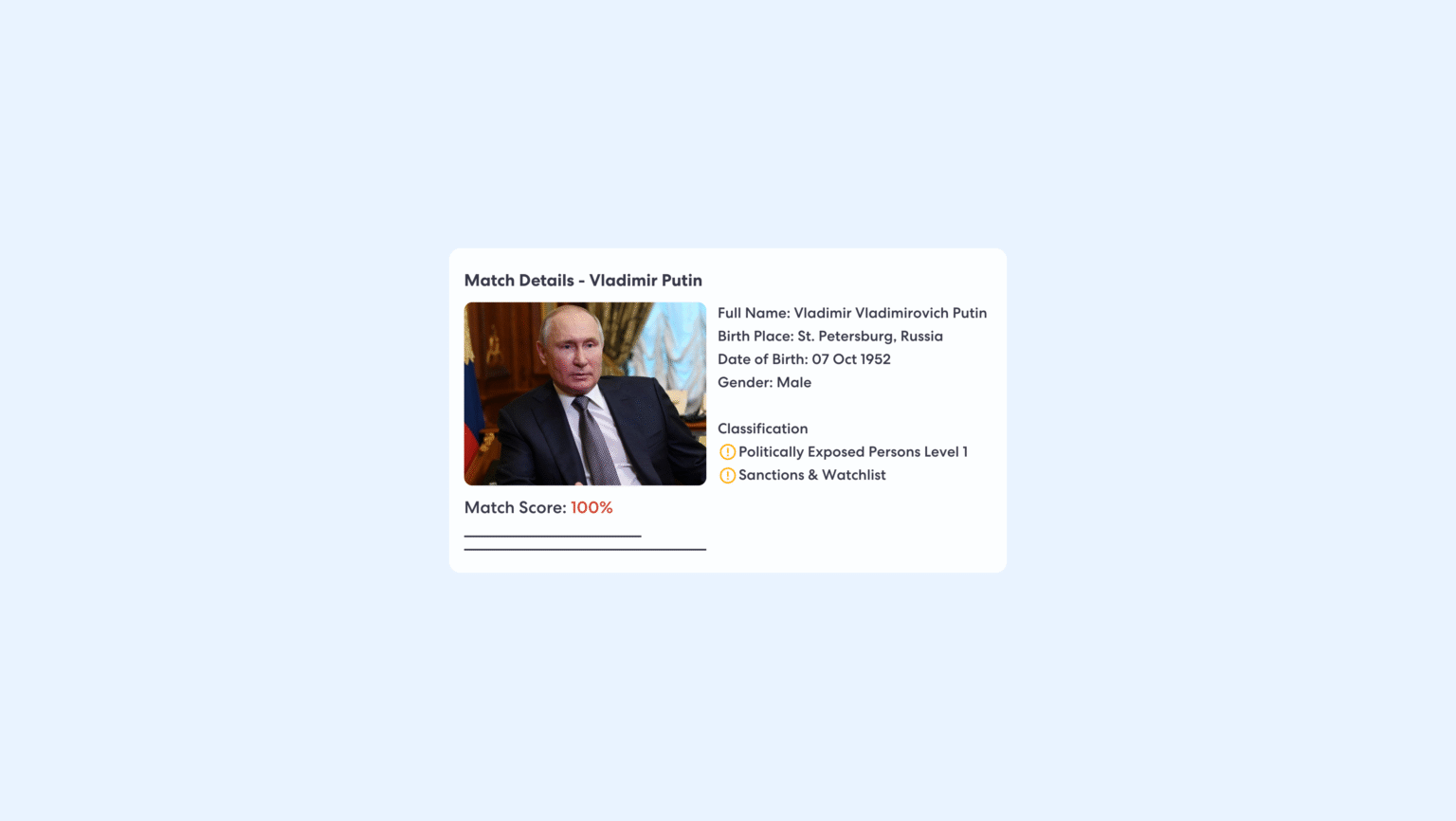

To understand how sanctions and watchlists work, let’s look at a well-known example: Vladimir Putin. Governments create sanctions lists to restrict people or organizations involved in activities they want to stop, like violating international laws or threatening security. In Putin’s case, the U.S. and other countries imposed sanctions because of his role in the conflict in Ukraine. These sanctions block his assets and prevent U.S. companies and individuals from transacting with him. Putin is also considered a Politically Exposed Person (PEP), which means he holds a powerful public position. While family members or close associates of PEPs may be checked more carefully because of potential risks, they are not automatically added to sanctions lists just for being connected.

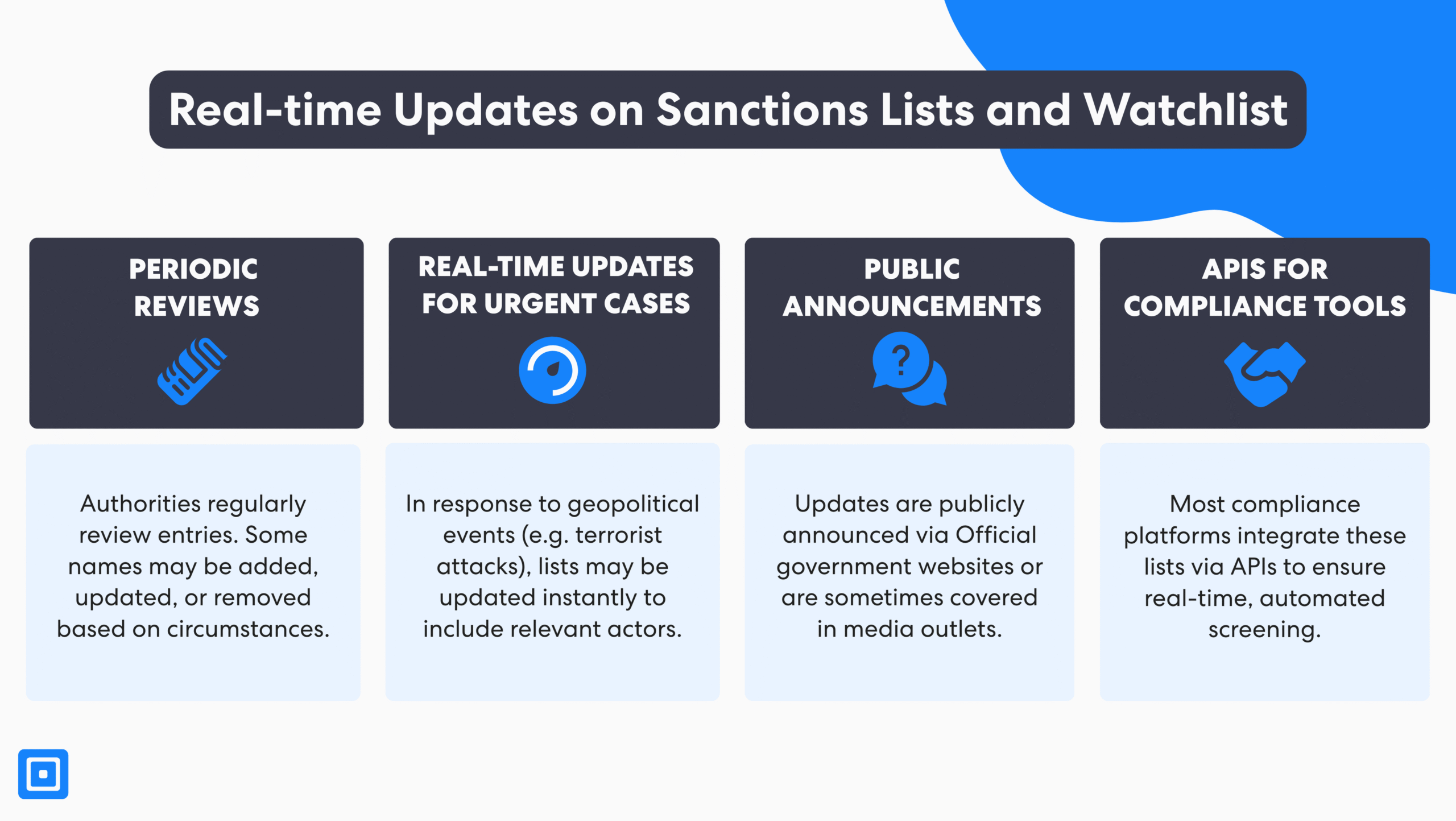

Real-time Updates on Sanctions Lists and Watchlist

Regulatory bodies, such as the U.S. Treasury’s Office of Foreign Assets Control (OFAC), the UN, and the EU, constantly review intelligence, legal developments, and international law to add or remove individuals, entities, or countries from sanctions lists. These updates reflect new threats related to financial crime, money laundering, terrorist financing, and Politically Exposed Persons (PEPs).

Financial institutions rely on advanced screening software and automated screening systems that integrate these updates instantly through secure data feeds and APIs. This seamless process ensures compliance teams always use the latest information when conducting sanctions, customer, and payment screening. By maintaining a thorough and ongoing process of updating, institutions can quickly identify potential risks, minimize false positives, and adapt their AML screening process to mitigate risks in the global financial system.

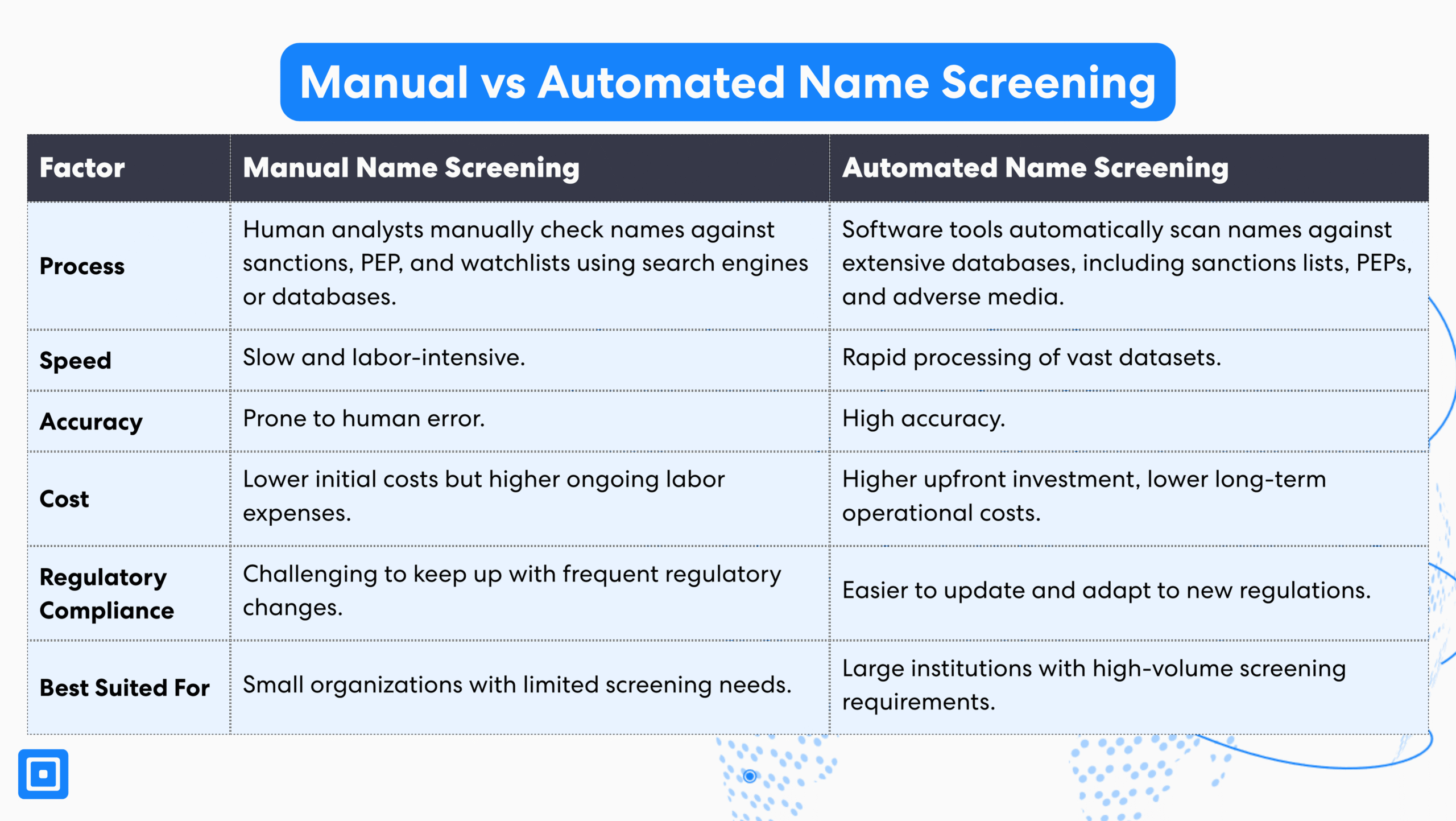

Manual Versus Automated Name Screening in AML

Many businesses may stick to manual name screening to save on costs. While this might be a good idea in the short run, it often requires significant resources, such as exporting the sanctions list and updating it daily. Manual AML screening can lead to delays in identifying potential criminal activity. In contrast, automated name-screening tools enable firms to handle large data volumes quickly, accurately, and transparently.

Common Challenges for Name Screening in AML

A large number of challenges may arise from utilizing weak name-screening tools in AML processes. Take Starling Bank, for example, which was hit with a massive £28.96 million by the UK’s Financial Conduct Authority (FCA) due to its shortcomings in the anti-money laundering and financial crime sanctions screening process. The bank relied on outdated systems, screening only a fraction of the full sanctions list since 2017. As a result, over 54,000 bank accounts were opened for 49,000 high-risk customers, enabling them to conduct financial transactions between September 2021 and November 2023. As you can expect, this action has a trickling effect and may unintentionally pose financial harm to unsuspecting fraud victims. In this section, let’s explore the most common challenges of name screening for AML.

Managing Large and Diverse Data Sets

When onboarding tens of thousands of merchants and customers daily, keeping track of these large data sets can be overwhelming, especially when using a manual name-screening process. Additionally, without advanced customization, compliance officers can focus on the wrong individuals instead of those who are high-risk.

Solution: Risk Categorization to Tailor Compliance Responses

Businesses can improve compliance processes by categorizing risk and tailoring responses accordingly. For example, risk management features such as adjusting risk thresholds based on specific risk appetite means organizations can apply stricter checks to clients from high-risk countries or industries while using simpler checks for low-risk clients. Furthermore, tools such as fuzzy logic and applying exclusion rules (such as omitting clients who are deceased or inactive) help focus resources where they matter most. These strategies improve the accuracy of identifying high-risk matches while reducing the likelihood of false positives.

Evolving Sanctions and Regulatory Requirements.

Sanctions lists and watchlists undergo hundreds of changes every year, often being updated more than once a day. Manually handling all screening processes involves exhausting significant resources to organize information and prioritize tasks to make these complex data sets more manageable. Even with diligent attention to detail, this approach leaves a large gap for human error.

Solution: Robust Customer Due Diligence (CDD) and Continuous Monitoring

Advanced all-in-one compliance platforms such as ComplyCube offer businesses robust customer due diligence during the onboarding process and continuous monitoring. The aim is to understand who the customer is and to identify any potential risks before entering into a business relationship. Furthermore, compliance teams can choose to stay up-to-date with new risk notifications delivered right to their inboxes. For example, a firm can be notified immediately of urgent risk, enabling it to take prompt action and make compliance proactive rather than reactive.

Dealing with Language and Cultural Name Variations

There are many instances where customers might get incorrectly flagged as high-risk, or conversely, high-risk clients may not be flagged at all by compliance software. Names can be spelt or structured differently across cultures, and many compliance systems designed around Western naming conventions may struggle to identify individuals from diverse backgrounds accurately. This issue is quite common, so choosing the right AML/KYC Vendor that excels in handling global name variations and delivers high accuracy in fraud prevention is essential.

Solution: Integrating Advanced AI and NLP

The solution lies in integrating advanced Artificial Intelligence (AI) and Natural Language Processing (NLP) technologies into compliance processes. Tools such as fuzzy name-matching techniques and sophisticated machine-learning models can recognize and account for different spellings, transliterations, and cultural naming patterns. For example, a single name might appear in multiple forms depending on the language or region. AI-powered platforms can learn to connect these variations to the same individual. These technologies are continuously improved by user feedback and real-world data, making them more effective over time.

The Ethics of Name Screening and How it Impacts Real People

The implementation of name screening can have profound and sometimes unintended consequences on people’s lives. While strict AML processes aim to build a safer financial ecosystem, innocent individuals may sometimes get flagged for no reason at all. When someone is mistakenly identified as high-risk, a situation known as a false positive, it can result in real consequences like having their accounts blocked or suffering damage to their reputation.

In the end, ethical name screening should prioritize transparency, accountability, and a genuine effort to reduce harm while still meeting regulatory requirements.

Joshua Vowles-Dent, Business, Strategy & Partnerships Manager at ComplyCube, points out, “We often hear stories of legitimate customers who can’t open a bank account or set up a profile on a platform because their name is similar to someone on a sanctions list. This can cause major distress to the client and impact on their day-to-day activities. In the end, ethical name screening should prioritize transparency, accountability, and a genuine effort to reduce harm while still meeting regulatory requirements.”

Name Screening in Emerging Markets and Non-Western Contexts

Name screening in emerging markets and non-Western contexts can be quite a challenge due to several factors. Many regions have non-Latin alphabets and complex naming conventions, which can create confusion when trying to match names accurately. For example, names might include patronymics, multiple family names, or vary in order, making it hard to pinpoint the correct individual. Transliteration adds another layer of complexity, as names can be spelled in various ways when converted from one script to another. Take “Mohammed,” for instance; the same person could be listed as “Muhammad” or “Mohamad” depending on the record. This inconsistency definitely increases the risk of false positives or negatives during screenings.

Cultural nuances also play a huge role. For example, in certain Asian countries, surnames come before given names, while in others, middle names might be used more prominently. Plus, in areas with limited digital infrastructure, data can often be incomplete or inconsistent, which adds more difficulty.

Harry Varatharasan, Chief Product Officer at ComplyCube, speaks to this point, “The responsibility of using ethical and explainable AI lies in the hands of compliance providers. They must ensure that AI systems are designed and implemented with a strong focus on ethical considerations and transparency. This includes regularly auditing algorithms for bias, providing clear explanations of AI decision-making processes, and adhering to regulatory standards.”

Best Practices for AML Screening

Effective AML screening requires a combination of state-of-the-art technology, processes, and expertise. Some best practices for name screening in anti money laundering includes implementing a proactive risk approach, conducting thorough ongoing monitoring, and equipping risk management teams with regular training.

Implement a Risk-based Approach

Above all, embracing a proactive risk-based approach is essential. This entails aligning the name screening process to a customer’s risk profile, with greater focus on high-risk customers, Politically Exposed Persons (PEPs), and sanction-listed individuals. By allocating resources where financial fraud and suspicious activity risk is greater, compliance professionals can minimize risks more effectively and tackle them early.

Leveraging Automated AML Screening Tools

Automated screening software is also a feature of modern AML compliance. Manual screening can be susceptible to human error and is not feasible for large data sets of financial transactions. However, automated systems and advanced screening software enable institutions to conduct real-time name screening, sanctions screening, and adverse media searches. These solutions help in minimizing false positives and enhancing the detection of threats such as terrorist financing and illegal activities related to worldwide law offenses.

Conduct Ongoing Monitoring

AML name screening is an ongoing process. Continuously monitoring customer activity allows financial institutions to detect changes in a customer’s identity or behavior that require further scrutiny. From onboarding new clients to screening existing customers, it is essential that screening systems are kept current so that organizations can keep up with new ways of financial crime and changes in sanctions legislation.

Complying With Strict Regulations

AML compliance protects a firm’s procedure against all relevant regulatory mandates, for example, the Bank Secrecy Act and global AML mandates. Sanction screening is a procedure that properly includes conducting sanctions screening against available lists from bodies such as OFAC, the EU, and the UN. Institutions must be on their guard in maintaining compliance, accuracy, and up-to-dateness of their AML screening procedures to avoid exposure to the law and reputation impairment.

Regular Check-ins and Training With Employees

Finally, no thorough screening procedure is finished without investing in those who do the screening. Compliance officers must be periodically trained to keep abreast with the latest AML directives, the usage of screening software, and the institution’s own risk appetite. Team member training with skills and expertise for identifying risks and screening meticulously helps build a culture of accountability. It improves the overall efficiency of AML name screening procedures in the entire financial sector.

By following these best practices, financial institutions can ensure that their AML screening process effectively identifies and mitigates money laundering risks, thereby protecting their business operations and maintaining regulatory compliance.

The Critical Role of Name Screening in Ensuring AML Compliance

Name screening in AML is a fundamental component of effective compliance that helps financial institutions detect and prevent financial crimes such as money laundering, terrorist financing, and financial fraud. Utilizing advanced screening tools, including AI and machine learning, enhances the accuracy of the process by reducing false positives and managing the complexities of global financial transactions. Ongoing monitoring and a risk-based approach enable compliance teams to continuously assess customer risk profiles, adapt to regulatory changes, and mitigate potential risks associated with high-risk individuals or entities.

By conducting thorough screening during onboarding and maintaining vigilant continuous monitoring, firms can uphold AML compliance, protect the integrity of the financial system, and contribute to the fight against illegal activities. An effective sanctions screening process ensures regulatory adherence and fosters trust and fairness within the financial sector, making it a vital part of a comprehensive AML strategy. Speak to a member of the team to get started today.