A question every business should be asking themselves in 2024 is, what is synthetic identity fraud? Synthetic identity fraud involves combining real information pertaining to a person’s identity with fake information, creating a new deceptive fictional identity. It’s extremely difficult to detect a synthetic identity, as bad actors often “nurture” them over time in order to gradually build up a desired credit profile. This form of identity fraud is becoming increasingly widespread, with financial institutions, fintech apps, and trading platforms often being targeted. The rise of synthetic identity fraud is also supported by an increasing amount of personally identifiable information being readily available on the dark web. Businesses must be aware of the risks that these deceptive identities entail and safeguard their organizations with comprehensive IDV and KYC solutions.

The Anatomy of a Synthetic Identity

A synthetic identity is created by combining real and fake personally identifiable information, such as a Social Security number, name, and address. Synthetic identities can be used to open bank accounts, apply for loans, and make fraudulent purchases. There are several forms of synthetic identity fraud, including identity compilation and identity manipulation, both of which are often used to create a fake credit history, making it easier to commit fraud.

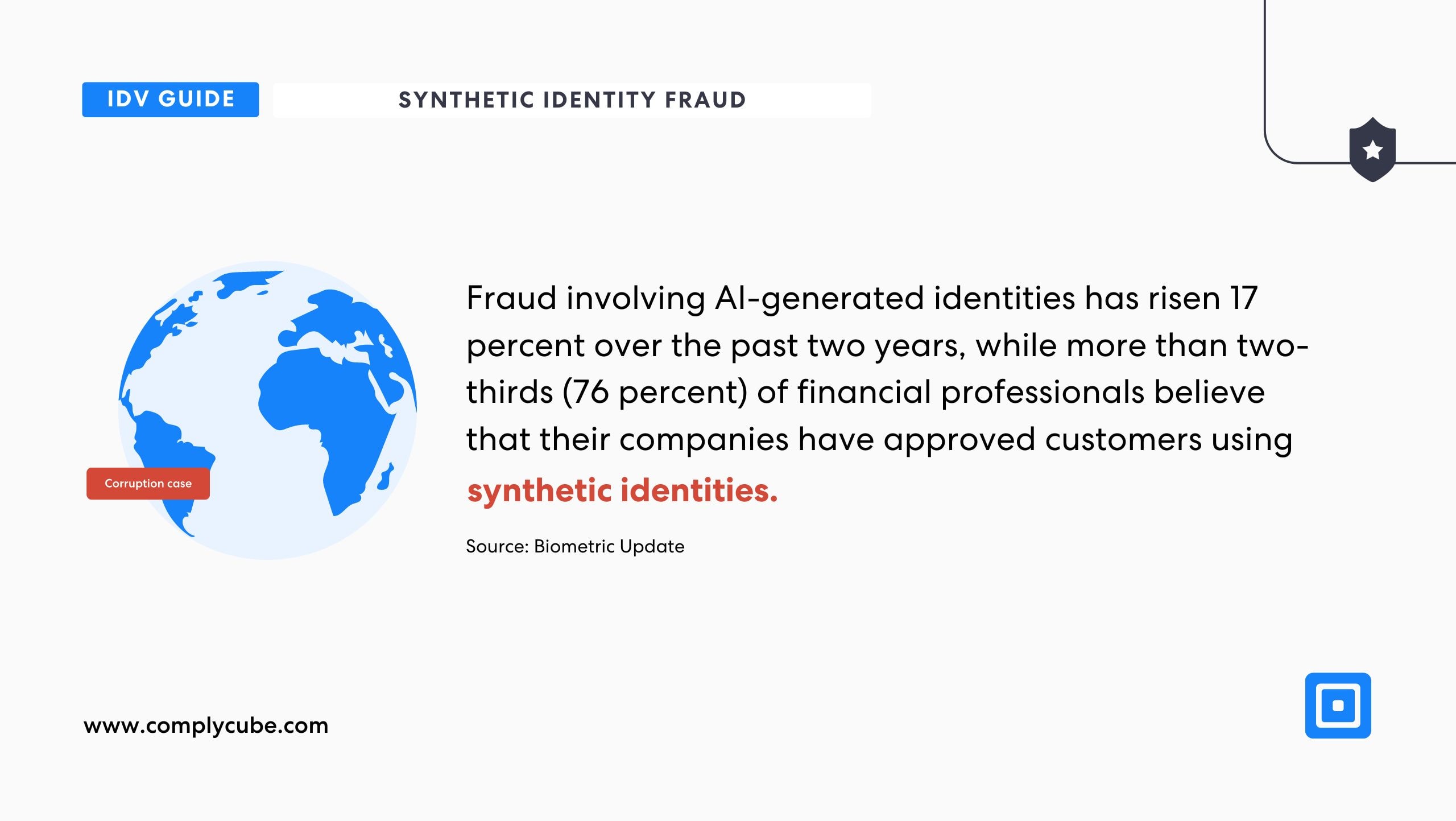

Research published towards the end of 2023 highlighted the growth of synthetic identity fraud caused directly by the development of AI. Biometric Update reported that “fraud involving AI-generated identities has risen 17 percent over the past two years, while more than two-thirds (76 percent) of financial professionals believe that their companies have approved customers using synthetic identities.” As fraud evolves due to the availibility of AI-powered tools, businesses must similarly leverage these tools to stay one step ahead.

Synthetic identity fraud is often a long-term game. Unlike traditional identity theft, synthetic fraudsters often cultivate identities over time, gradually building up a credit profile that appears legitimate. This carefully planned approach allows bad actors to avoid immediate detection. Eventually, the synthetic identity appears to be credible, and fraudsters can take out larger loans or credit lines before disappearing. Hence, it has become a preferred method for fraudsters, especially with the help of AI-generated identities.

The Impact of Synthetic Identity Theft

A Transunion report at the end of 2023 looked into the growth and trends of digital fraud, highlighting that “data breaches in the U.S. increased 15% year over year in 2023, with 54% of consumers across 18 countries and regions reportedly targeted in online, email, phone call or text messaging fraud attempts from September to December of last year.” Increased data breaches, as well as the availability of sensitive data online, has led to the rise in synthetic identities. KPMG highighted the severity of the issue in 2022, pointing out in a recent piece that synthetic fraud is a $6 billion dollar problem, and “the fastest-growing financial crime in the United States.”

The fastest-growing financial crime in the United States.

Synthetic identity theft can have a significant impact on individuals, including damage to their credit history and financial losses. Victims may experience a split or fragmented credit file, making it difficult to obtain credit or loans. Synthetic identity theft can also have a significant impact on businesses, including financial losses and damage to their reputation. The impact of synthetic identity theft can be far-reaching, affecting various sectors, including financial services, healthcare, and government entities.

It’s estimated that 95% of synthetic identities are not detected during the onboarding process.

With nearly two-thirds of financial professionals believing that their company has approved customers who are using synthetic identities, most businesses without comprehensive verification processes are running a very serious risk. Thomson Reuters argues that “at financial institutions, it’s estimated that 95% of synthetic identities are not detected during the onboarding process. At many e-commerce and retail sites, losses due to synthetic identity theft are either never detected or simply written off as an unrecoverable cost of doing business.”

Protecting Against Synthetic Identity Fraud

The issue with synthetic identity fraud is that detecting it during an application/onboarding process is extremely difficult. KPMG states, “despite its growing rate, synthetic identity fraud remains nearly impossible to flag during the application process. The ability to create an unlimited number of identities, coupled with how challenging they are to detect, makes synthetic identity fraud a popular choice among cybercriminals.”

Despite its growing rate, synthetic identity fraud remains nearly impossible to flag.

To protect against synthetic identity fraud, businesses should invest in advanced identity verification and due diligence tools to detect and prevent synthetic identity fraud. By employing advanced identity verification techniques that include biometric checks, document authentication, and cross-referencing data across multiple sources, companies can detect inconsistencies that signal synthetic identities. Additionally, integrating machine learning to continuously enhance detection capabilities helps stay ahead of new fraudulent practices.

What’s Needed? IDV Checks with ComplyCube

Detecting synthetic identities requires robust, multi-layered verification methods, and ComplyCube’s biometric and document verification solutions are able to effectively safeguard businesses and invididuals against this threat.

Their liveness detection technology guaratnees that the person presenting the identity is alive and present, mitigating the risk of AI-generated or spoofed identities. The integration of facial recognition and document validation ensures that the identity details are authentic and not fabricated. By combining biometric, document, and behavioral analysis, synthetic identities can be flagged early, preventing fraudsters from nurturing fake credit histories or gaining unauthorized access. Some of the features of their solutions include:

Robust facial recognition and similarity: ComplyCube’s advanced ISO 30107-3 and PAD Level 2-certified biometric liveness detection technology ensures that the person presenting an identity document truly matches the submitted details. Their Identity Verification (IDV) system combines biometric and behavioral analysis to provide a highly secure and reliable identity verification process, offering a robust level of assurance in detecting fraudulent or synthetic identities.

Advanced document verification: ComplyCube utilizes a blend of AI technology and expert review to meticulously verify ID documents, ensuring they haven’t been altered, forged, copied online, expired, or blacklisted. This rigorous process supports various types of documents, including passports, driver’s licenses, national ID cards, residence permits, visa stamps, and travel documents, providing a comprehensive layer of protection against identity fraud.

Expert liveness detection: Their AI-powered PAD-Level 2 liveness detection software accurately confirms genuine customer presence and flags imposters. By incorporating advanced anti-spoofing technology, ComplyCube effectively safeguards businesses from even the most sophisticated fraud attempts.

Seamless biometric enrolment: A top-tier guided face capture technology that ensures seamless authentication for accessing Finance, Telecommunications, Travel, Enterprise Services, and more.

Protect Your Business Today

Synthetic identity fraud is a growing concern, with losses in the multi-billions. It’s essential to understand the anatomy of a synthetic identity and the impact of synthetic identity theft. Protecting against synthetic identity fraud requires advanced identity verification and due diligence tools and a robust identity verification process.

By understanding the role of technology in synthetic identity fraud and implementing business protection strategies, individuals and businesses can minimize the risk of synthetic identity fraud.

Contact one of ComplyCube’s compliance experts and put measures in place to protect your organisation today.