Establishing an entity’s Ultimate Beneficial Ownership (UBO) can be very challenging and demands Know Your Business (KYB) technologies to help enable compliance. The common UBO meaning is the individual or group who is in control of and responsible for actions taken by another entitity.

This guide demonstrates what a UBO is, how some common methods are used to conceal real ownership, and why it can be so challenging to identify an institution’s genuine controller.

What is an Ultimate Beneficial Owner?

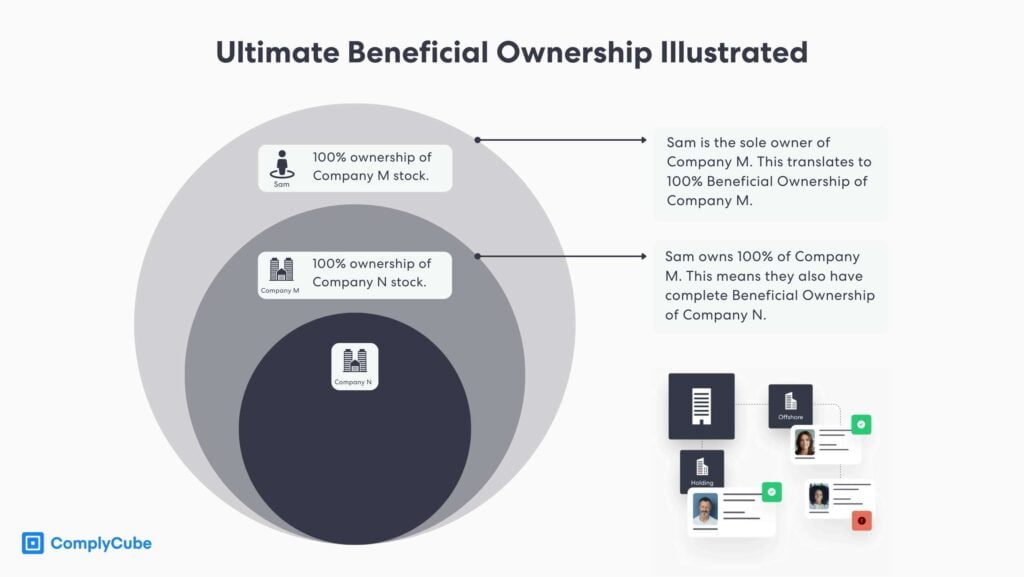

A UBO is the natural person or group of people who own and/or control another entity. Entities can range from another human being to a multi-billion dollar institution. While the beneficial owner might control a significant portion of responsibility, they might not be directly listed within a company’s official documents or an affiliate individual’s records.

The standard definition of Ultimate Beneficial Ownership is when 25% (or more) is controlled by one group or individual. Such a large stake grants the owner(s) unparalleled levels to exercise ultimate and effective control.

What is a UBO of a Company?

The beneficial owner of a company is the person or group that ultimately benefits from the business’s activities. This means they have the power to make significant decisions regarding the company’s operations, finances, and strategic direction.

Identifying the UBO is crucial for institutions establishing new business relationships. They must ensure that the operators of a partner company are compliant and operate legally. Not doing so could lead to non-compliance with financial and Anti-Money Laundering (AML) regulations or other corporate fines.

What is a Beneficial Owner of an Individual?

Beneficial ownership of an individual refers to someone who benefits from assets held by another person or entity. These cases often include individuals whose assets are held in trust funds or via custodial arrangements. In these cases, the UBO has the lawful right to obtain profits or other economic benefits from them, but the trustee holds legal ownership of the assets.

What is Know Your Business?

Know Your Business is the process used by institutions to identify the backgrounds of companies they might work with. This includes ascertaining the ownership structure (Ultimate Beneficial Ownership), financial and legal health, and compliance with laws such as AML regulations.

KYB solutions use advanced technologies to facilitate this process in a matter of minutes, reducing the time spent on due diligence and the cost of onboarding new businesses as well as enabling compliance with dynamic and potentially convoluted regulations.

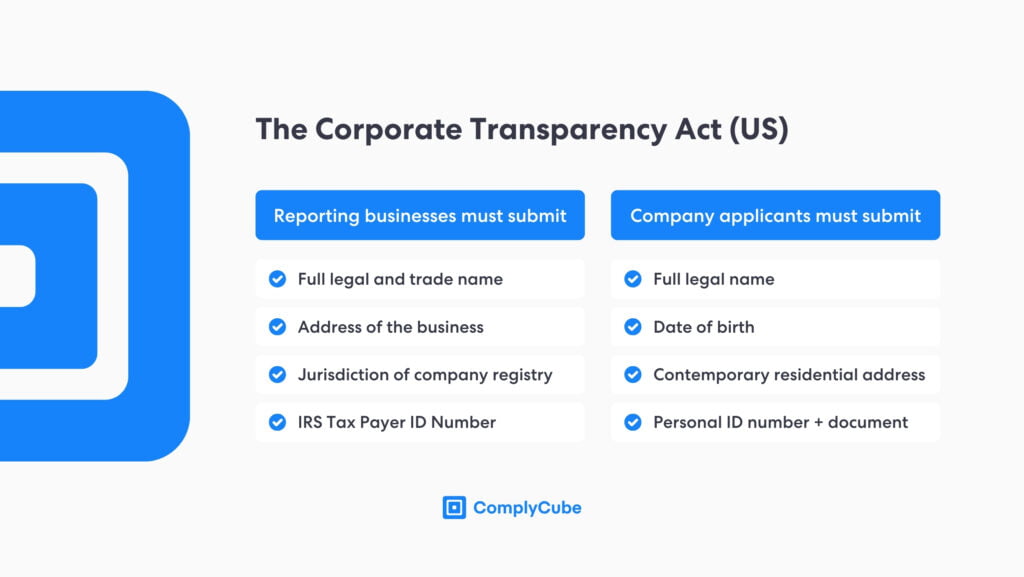

The Corporate Transparency Act (CTA) in the US

The Corporate Transparency Act, launched in 2021 but only taking effect on January 1, 2024, requires firms to submit particular information regarding beneficial owners—known as Beneficial Ownership Information Reports (BOI Reports). This information must be sent to the Financial Crimes Enforcement Network (FinCEN) as part of America’s AML Act of 2020 and its renewed mission to increase corporate and structural transparency.

The data a reporting company must submit:

- Full legal name and trade name

- Up-to-date address of the business’s place of trade/where the firm conducts business

- Jurisdiction of where the company is registered

- Inland Revenue Service (IRS) Tax Payer Identification Number (TIN)

The data each company applicant and the beneficial owner must submit:

- Full legal name

- Date of birth

- Up-to-date residential address

- Personal identification number and ID document

Challenges of Finding the Ultimate Beneficial Owner

Firms face many challenges when establishing an entity’s, institution’s, or individual’s UBO. These include layered ownership structures, data opacity, and regulatory discrepancies.

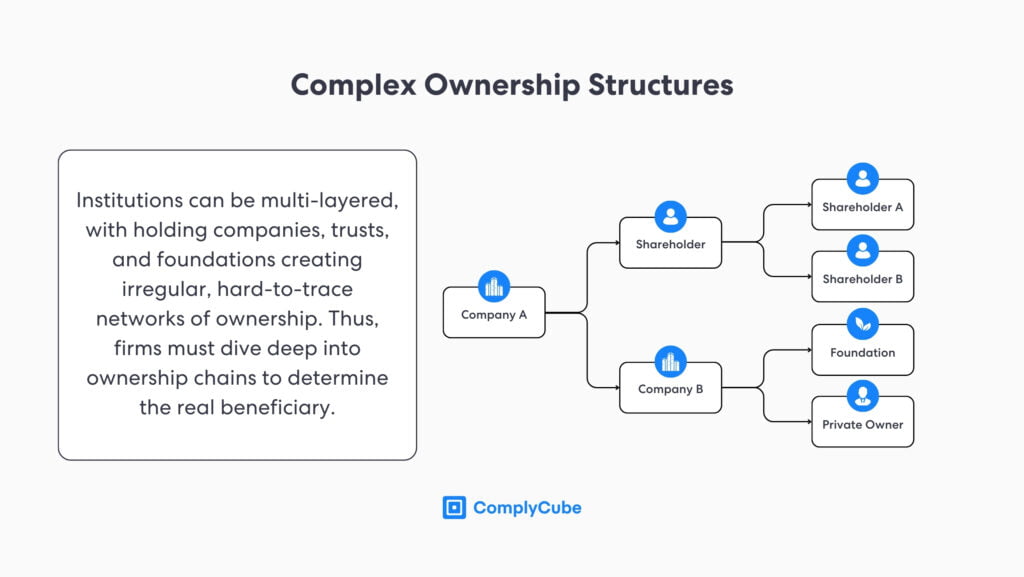

Complex Ownership Structures

One of the significant challenges in identifying the ultimate beneficial owner (UBO) of an individual is navigating complex ownership structures. Many individuals and some institutions structure the ownership of their assets or company in layered arrangements, using holding companies, trusts, or offshore entities to obscure the true ownership of assets or equity.

These structures can create an irregular network of ownership that makes it difficult to trace back to the ultimate owner. The use of intermediaries or nominees further complicates this process, as the legal title might not reflect the true owner of the assets. Institutions must sometimes dive far deeper than the surface-level ownership to determine the real beneficiary.

Lack of Transparency

Many regions have stringent privacy laws that protect the identity of beneficial owners by law, making it extremely difficult to obtain the required information. Typically, the lack of beneficial ownership transparency occurs in tax havens or secrecy jurisdictions that offer a high level of confidentiality, which can shield the identities of individuals seeking to conceal their ownership.

These protective laws, while legally justified, often purposefully hinder efforts to reveal the true beneficiaries of financial and corporate structures. This poses a significant challenge for regulators wishing to prevent financial crime and financial institutions, among other businesses, looking for safe partnerships.

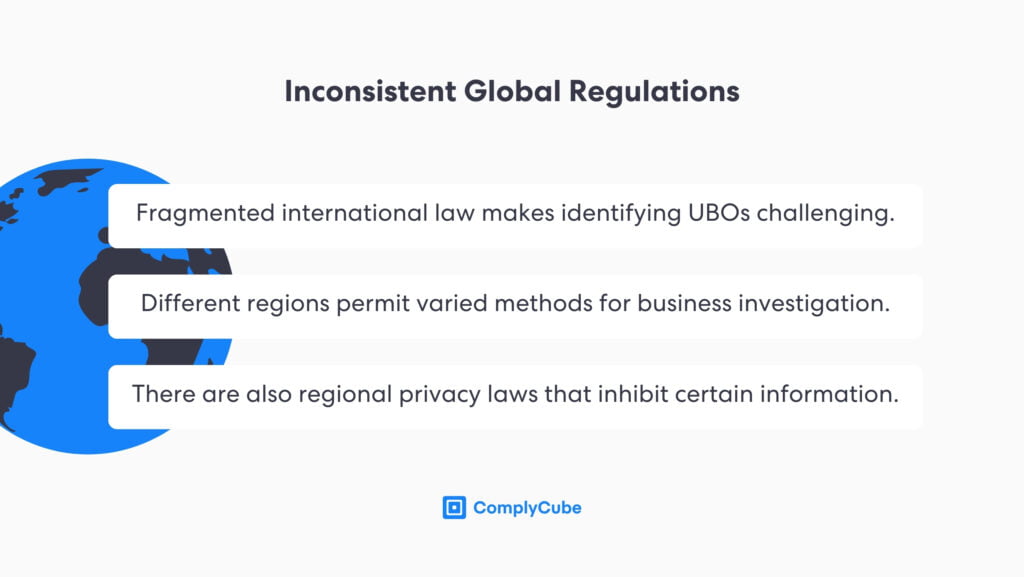

Inconsistent Regulations

Jurisdictional inconsistency in regulation can prove another steep hurdle for firms. The lack of a global standard for identifying the Ultimate Beneficial Owners of legal entities allows different countries to define beneficial ownership differently. Fragmented regulations lead to disparate methods of UBO identification.

This divergence in regulation means businesses may have to employ different methods of identification in different regions where the firm operates, leading to high compliance costs to facilitate different UBO verification methods.

Use of Trusts and Foundations

Trusts and foundations can separate legal and beneficial ownership, adding to the complexity of identifying UBOs. Trustees hold the legal rights to the assets in question, but the beneficiaries enjoy the rewards.

Identifying the UBO can be challenging for various reasons, including trustee discretion, confidentiality agreements, and dynamic asset entitlements. Foundations obscure fund ownership by separating the control and benefits of the underlying assets.

Deliberate Concealment

Malicious individuals or firms knowingly contravening AML laws might choose to purposefully conceal an institution’s true nature and ownership. Shell companies, sophisticated financial instruments, or nominee shareholders are all viable methods for deliberately concealing the true ownership of large entities.

These evasive tactics are designed to obscure true ownership and the value of the ownership stake, making it difficult for authorities or other companies to identify the Ultimate Beneficial Owner. Fraudulent activities, such as using false information to disguise the real owners, increase the complexity of the true identification of UBOs. Combatting these challenges, along with the others listed above, requires robust AML and KYC processes.

Technology and Resources

Identifying UBOs is, therefore, a resource-intensive exercise that requires sophisticated technologies to efficiently and affordably complete. Smaller companies with limited resources may struggle to implement robust systems for tracking and verifying UBOs. Technological barriers, such as outdated or incompatible IT systems, can hinder the efficient sharing and processing of beneficial ownership data.

The FATF recommends that firms invest in modern technologies and related resources to overcome these challenges. This will enable businesses and regulatory bodies to streamline processes, improve data accuracy, and ensure compliance with transparency requirements.

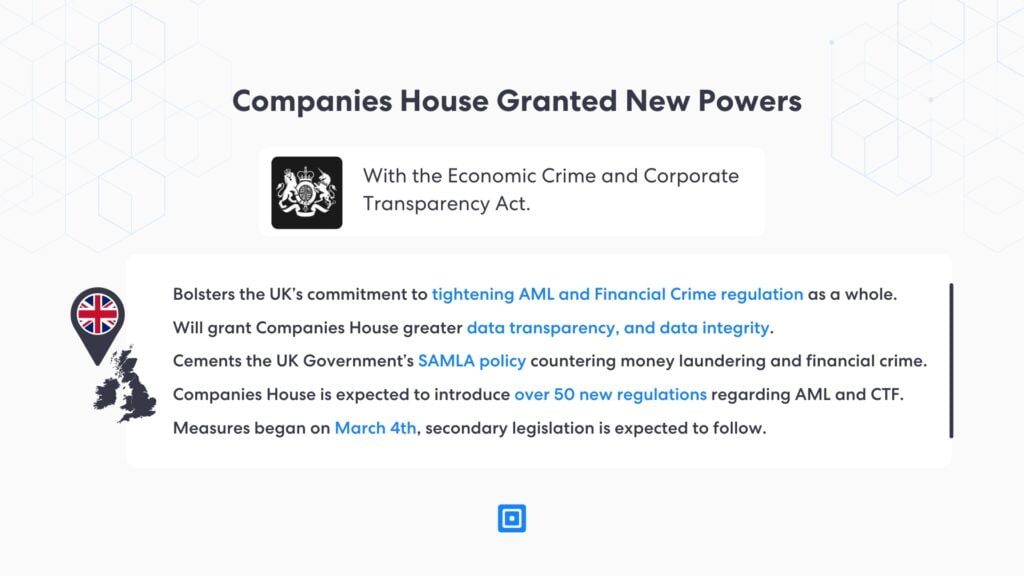

In its updated Recommendation 24, the Financial Action Task Force (FATF) provides guidelines on how firms should identify UBOs on a unified and global level. Furthermore, the UK released its Economic Crimes and Corporate Transparency Act in 2023/24, strengthening Companies House’s authority and setting a new global standard. The Act demonstrates the UK’s ambition to deliver the resources and create an environment to quell money laundering.

The Role of Know Your Business Solutions

KYB solutions play a crucial role in establishing and maintaining compliance with international regulations such as Ultimate Beneficial Ownership identification. Know Your Business is designed to help firms navigate the complexities of identifying and verifying the beneficial owners of their partners, clients, and other entities with which they engage.

By leveraging KYB technologies, such as ComplyCube, companies can significantly streamline their due diligence processes, reduce risks associated with financial crimes and money laundering, and ensure adherence to local and international Anti-Money Laundering regulations.

Time to Adopt Compliance Technology

The integration of sophisticated technologies, such as Artificial Intelligence (AI) and Machine Learning (ML), is vital in providing a swift identification process. When this is coupled with a sleek User Interface (UI) and User Experience (UX), compliance processes are significantly streamlined in both time and cost spent on due diligence.

ComplyCube’s KYB Solution

ComplyCube is a market-leading Know Your Customer (KYC) and KYB service provider. Their services are actively used around the world to navigate the complex legal and corporate structures used by firms to obfuscate identity and real ownership.

The global AML compliance firm sets new precedents in integration time. With a no-code, low-code, hosted solution, or full integration, partner firms have the option to start using ComplyCube’s hosted product in less than a day or integrate its AML solutions fully into their existing compliance tech stack.

Learn more about ComplyCube’s compliance offering by getting in touch with a KYB and AML specialist today.