Identity verification AI systems are crucial in powering modern-day client onboarding software. Innovative fraudulent methods have provoked this development, with many institutions looking for a new AI KYC solution for the 2020s. These onboarding systems include biometric and document verification AI technology that guarantees a far higher level of identity assurance than previous methods.

However, the benefits of switching to AI-powered Identity Verification (IDV) solutions go beyond enhanced regulatory compliance and the identification of malicious individuals or bad actors. This guide will discuss how AI-powered customer onboarding solutions can reduce business costs, improve compliance quotas, and act as a growth enabler.

Tackling Regulatory Compliance

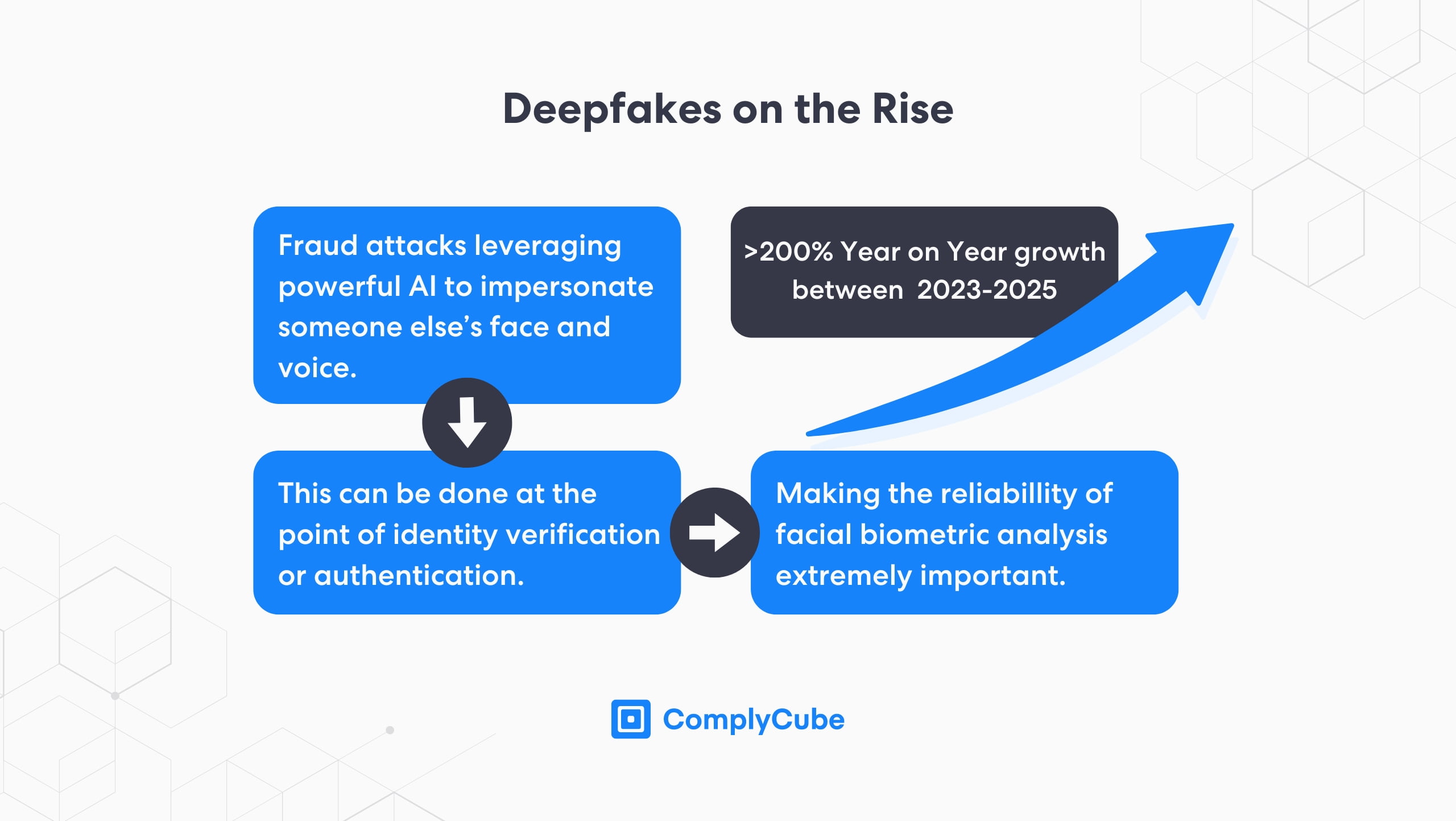

2024 has, unfortunately, been the year of the deepfake. Cases of identity theft via deepfakes have risen astronomically over the past year, leading many tech firms that deal with demanding levels of client acquisition to adopt AI-powered IDV methods. But what is a deepfake?

In a similar report published by Bitget, the exchange found that deepfakes will grow by 245% in 2024 alone and may account for 70% of all crypto crimes within the next two years.

The number of deepfakes in the crypto sector increased by 217% in 2023.

These figures are likely to expand into more general Financial Crime (FinCrime). These troubling statistics have led many tech firms, both in and outside of the blockchain world, to fight fire with fire.

Identity Verification AI Models

IDV is typically done in two stages. These include a method for verifying document authenticity and a method for analyzing and matching facial biometrics to the document stock image.

Document Verification AI Technology

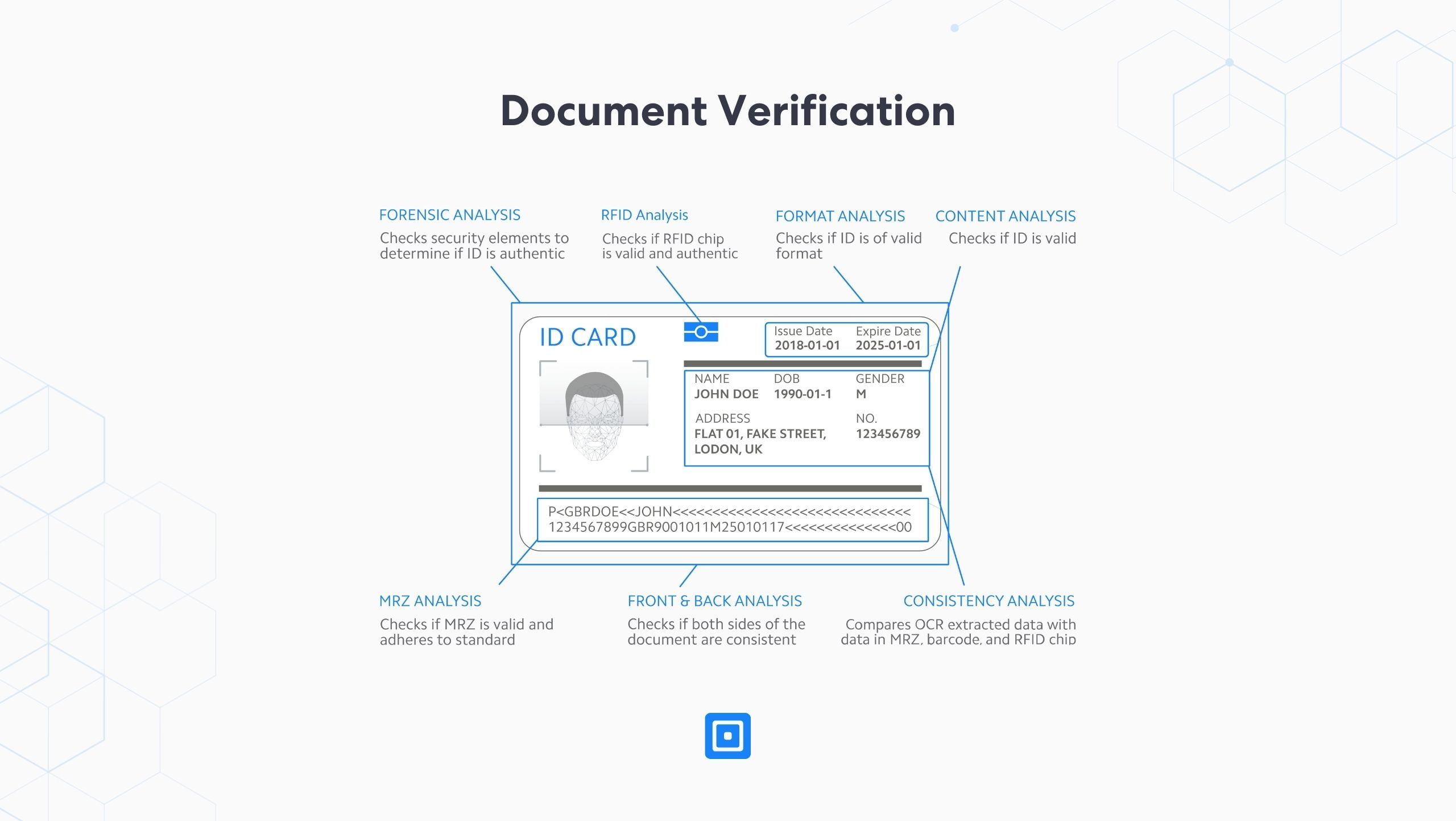

Document verification plays a pivotal role in the customer verification process and in securing personal identities for regulatory requirements. It involves a meticulous examination of IDs to confirm document authenticity and detect any signs of tampering or forgery.

Technological advancements have revolutionized this process, making it faster and more accurate. AI and Machine Learning (ML) technologies, combined with advanced computer vision algorithms and Optical Character Recognition (OCR), have significantly enhanced the efficiency of digital document authentication systems. The data extraction points can be seen below.

AI-powered ID verification uses this OCR technology to read and verify data from KYC documents in a matter of seconds. Using a comprehensive set of training data to mitigate bias, this powerful AI enables the processing of huge volumes of customer data in a very short space of time, creating a scalable yet accurate KYC onboarding methodology.

AI-Powered Biometric Verification Process

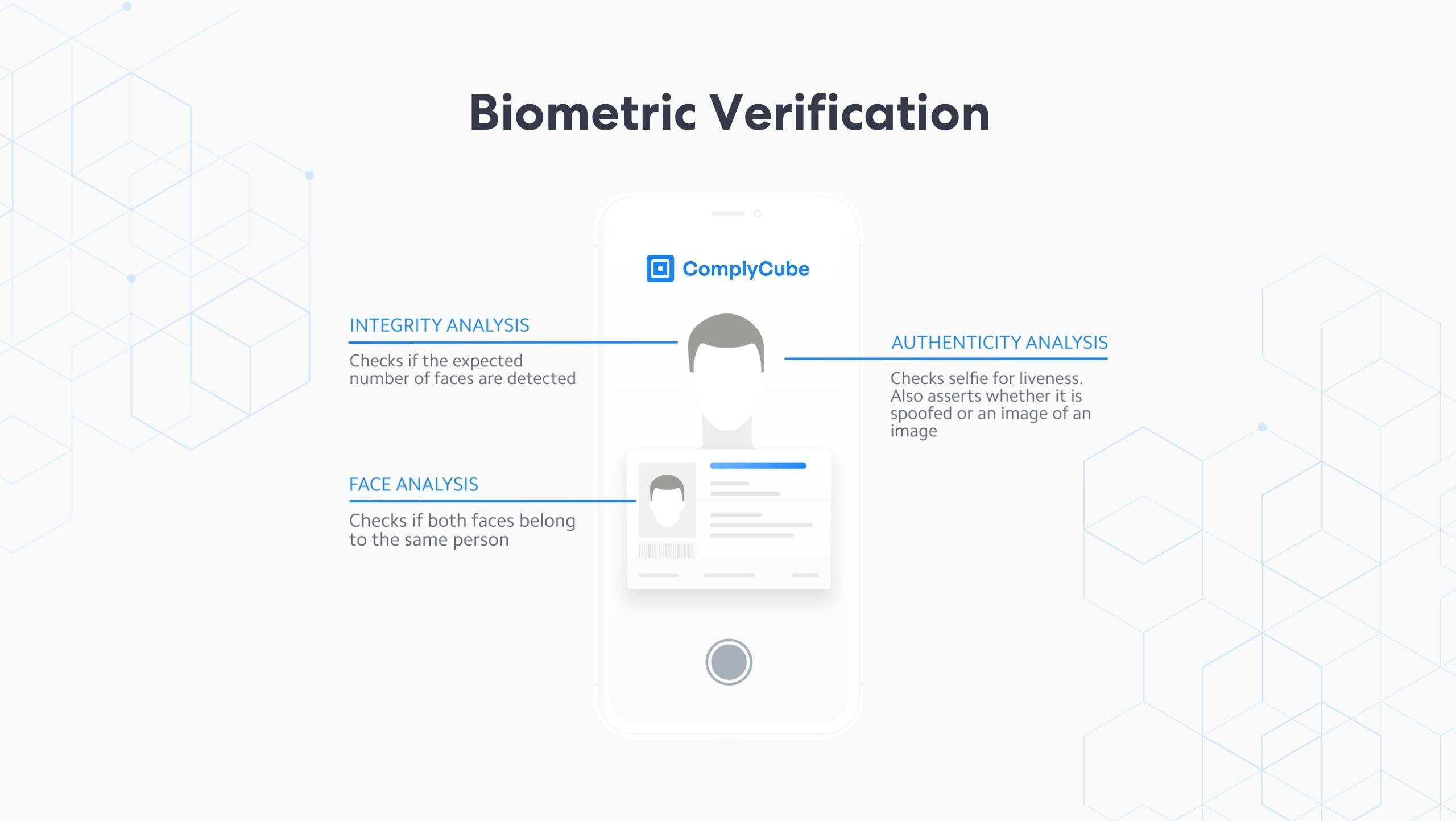

Biometric verification creates a heightened level of trust in identity with a robust solution against impersonation fraud and account takeover attacks. These attacks are increasingly common and costly for businesses. To learn more about the difference between biometric authentication and verification, read 2FA and Identity Authentication vs KYC Identity Verification.

ComplyCube’s biometric verification uses a propriety facial analysis and recognition system for verification and authentication use cases. Facial biometric verification improves account security to a probability level of less than 1 in 1,000,000.

Machine learning (ML) is critical to the success of this solution. Verification systems use ML algorithms to learn from existing data, recognize and detect patterns, and make decisions autonomously with 0 human interference. The data sets examined in a selfie or biometric verification can be seen below.

Autonomous biometric verification systems are now a critical component in a robust risk management strategy and are actively endorsed by major national and international regulatory bodies worldwide.

Automated Customer Onboarding Software

Together, these AI systems create an automated verification workflow for a streamlined customer journey. Multiple factors explain why these methods are being adopted around the world to seamlessly onboard millions of new clients to platforms in fintech, crypto, telecoms, and many other global industries.

Benefits of Identity Verification AI Systems

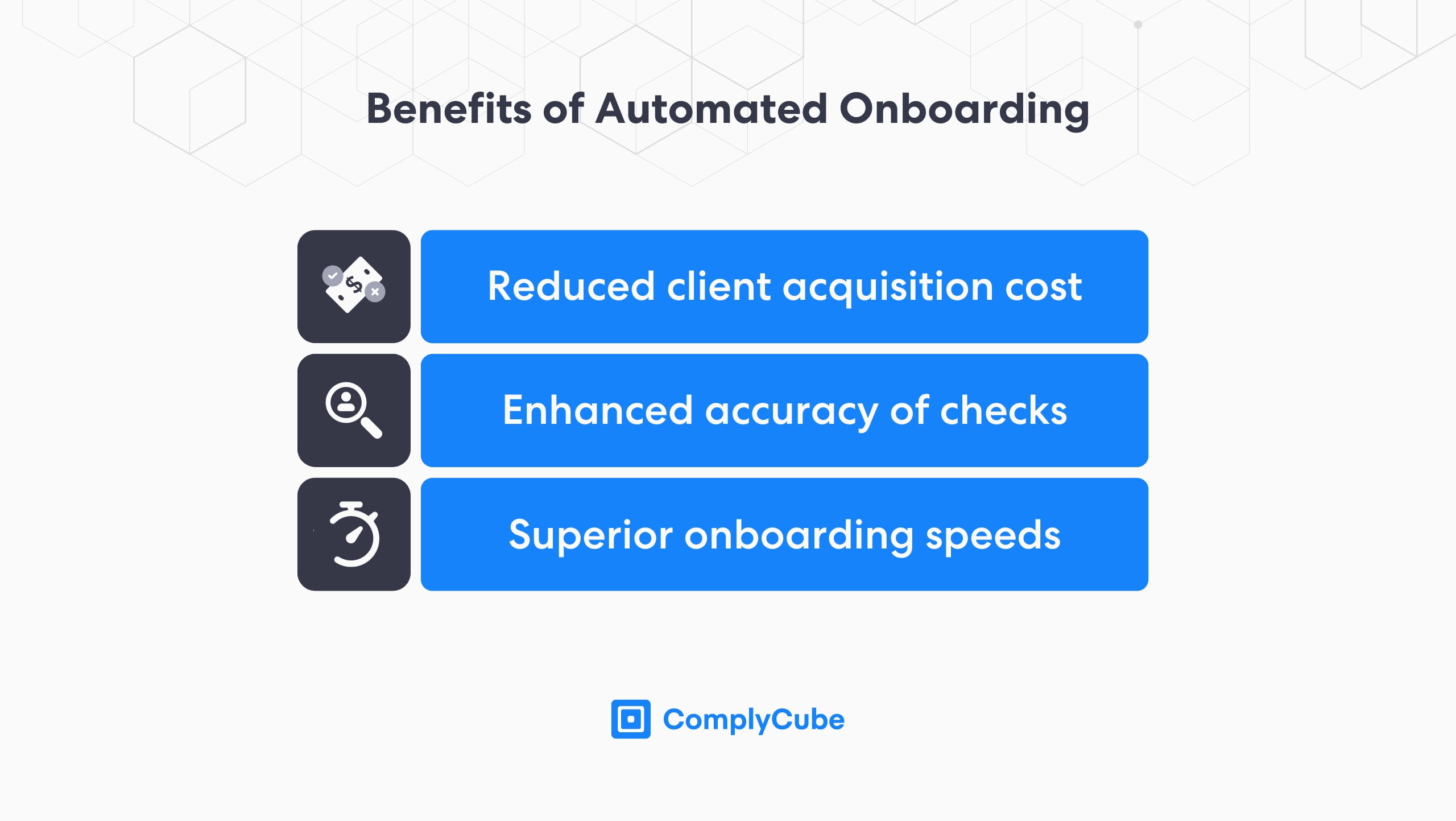

Automated identity verification systems bring numerous benefits. First and foremost, they provide a swift User Experience (UX) for new users. Secondly, the entire onboarding flow is autonomous and runs 24/7. A system that runs on its own with minimal human interference significantly reduces the time spent on individual onboarding administration, such as Customer Due Diligence (CDD), contributing to a strong first impression for partnered firms.

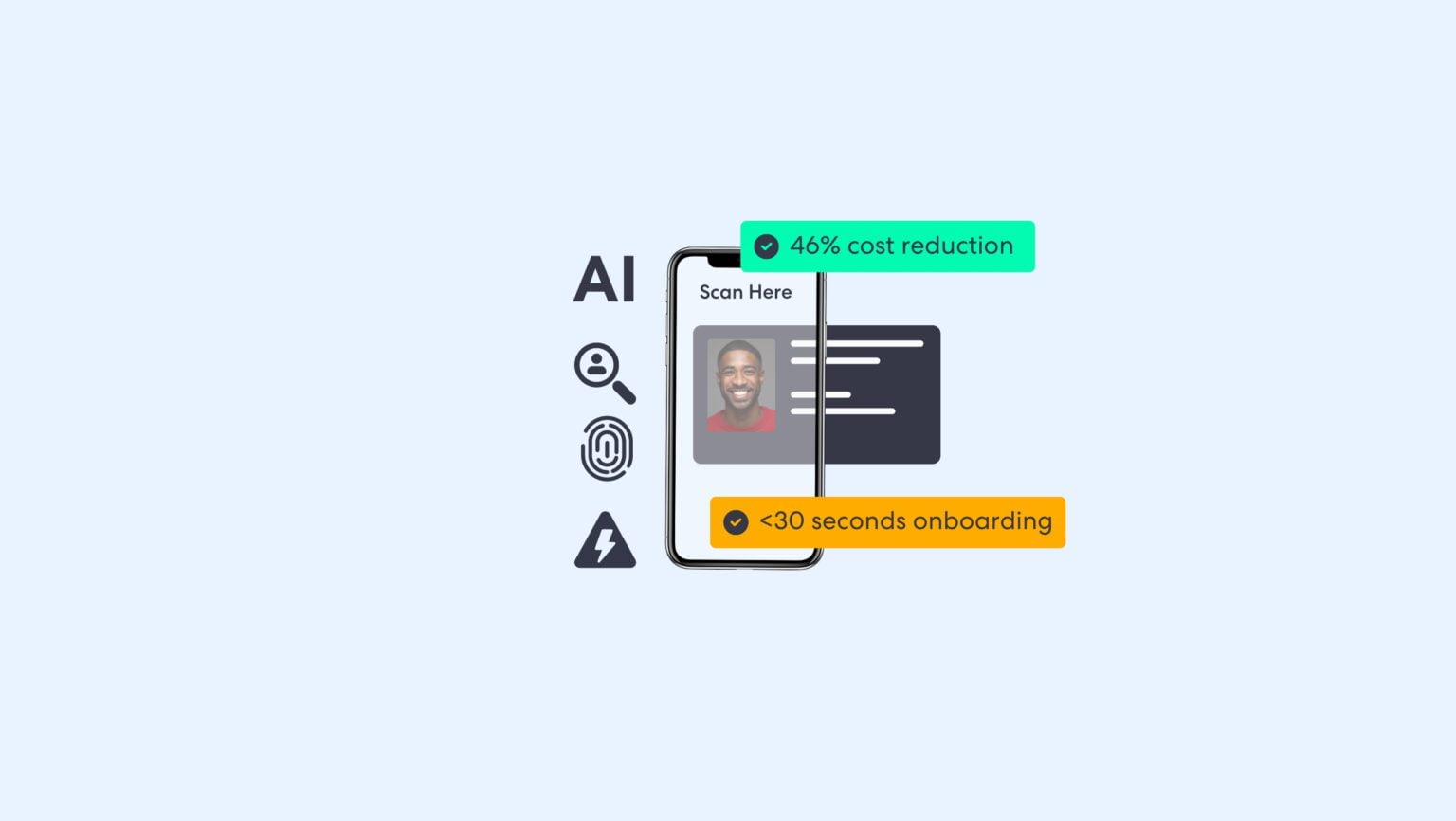

Onboard New Clients in Under 30 Seconds

This greatly reduces the Client Acquisition Cost (CAC), which ultimately increases a business’s margins. This is a strong incentive for businesses to explore automated IDV solutions. Client onboarding time can be reduced to less than 30 seconds, granting businesses more time to spend productively.

The time that compliance teams would have historically spent on customer onboarding administration can be more productively spent on alternative initiatives, such as growth and research and development strategies.

Another great incentive is the accuracy of these systems. Not only are these autonomous IDV systems incredibly scalable, but they also provide a higher level of identity assurance than manual or other digital systems can. Therefore, Identity Verification AI systems will satisfy regulators, ensure compliance with international standards, and mitigate the risk of corporate non-compliance fines.

Following swift signup and customer authentication, users are subjected to a host of AML checks conducted immediately in the background. AML checks, such as PEP screening and adverse media checks, deliver the necessary information to KYC teams to determine what kind of due diligence is needed—CDD or Enhanced Due Diligence (EDD).

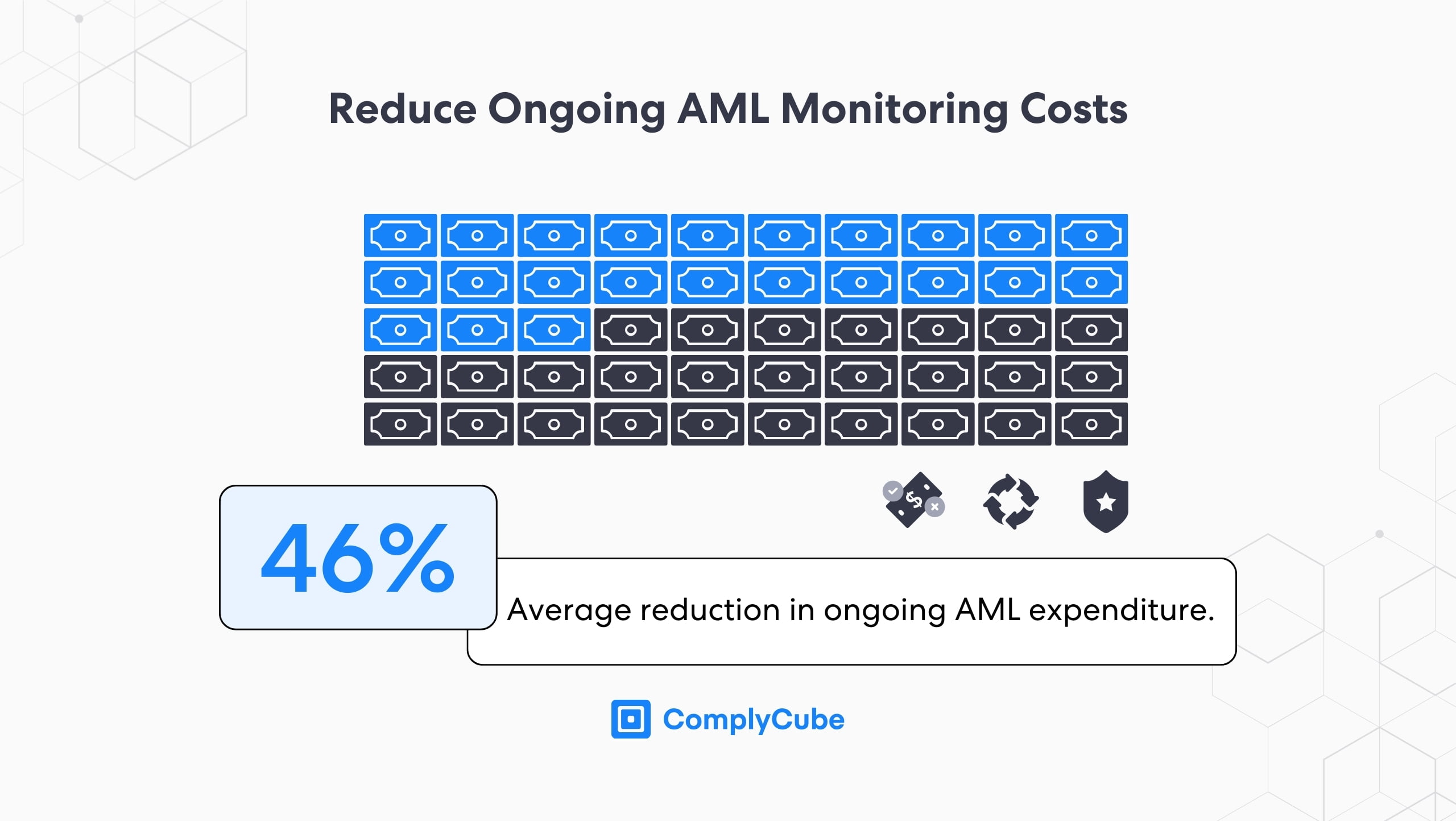

Reduce Ongoing AML Monitoring Costs by 46%

An autonomous continuous monitoring system perpetually scrutinizes individuals to ensure client data is up-to-date and firms have a contemporary understanding of potential risk. Integrating with a continuous AML monitoring system can reduce the cost spent on ongoing administration by over 46%.

These KYC solutions are widely recognized by financial institutions as the leading remedy for detecting and mitigating associated client risks, resulting in streamlined onboarding, reduction in business costs, and enhanced compliance.

ComplyCube’s Identity Verification AI Solutions

ComplyCube’s industry-leading IDV solutions leverage the firm’s proprietary AI and ML technologies. Building every solution in-house, the AML and KYC provider can provide extremely cost-effective solutions that beat or match competitors’ KYC solutions on accuracy and scalability.

This business model has enabled their swift growth into multiple technology markets, such as crypto, fintech, banking, and telecoms, among many other key industries that face dynamic regulations. ComplyCube’s solutions can be integrated into existing systems via powerful APIs or SDKs or via a hosted and no-code solution, depending on your business needs.

Challenged with Increasing AML and KYC Regulations?

If your business could use an Identity Verification AI solution to streamline onboarding and regulatory compliance, contact an AML, KYC, or IDV specialist and learn how ComplyCube’s suite of AI-powered solutions can help.