Adverse or Negative Media includes any unfavorable information obtained from various trusted news sources and outlets. An Adverse Media check can expose hidden AML risks such as association risk, Financial Crime (FinCrime) risk, or legal Risk. More on Adverse Media screening below.

What is Adverse Media Screening?

Adverse Media Screening involves interrogating reputable data sources for negative news associated with an individual or company. These checks can uncover hidden links with FinCrime or similar activities that may pose a reputational risk to the business. Therefore, Adverse Media Screening must be an integral part of the Know Your Customer (KYC) process to enable companies to identify and protect their business from various Anti-Money Laundering (AML) risks.

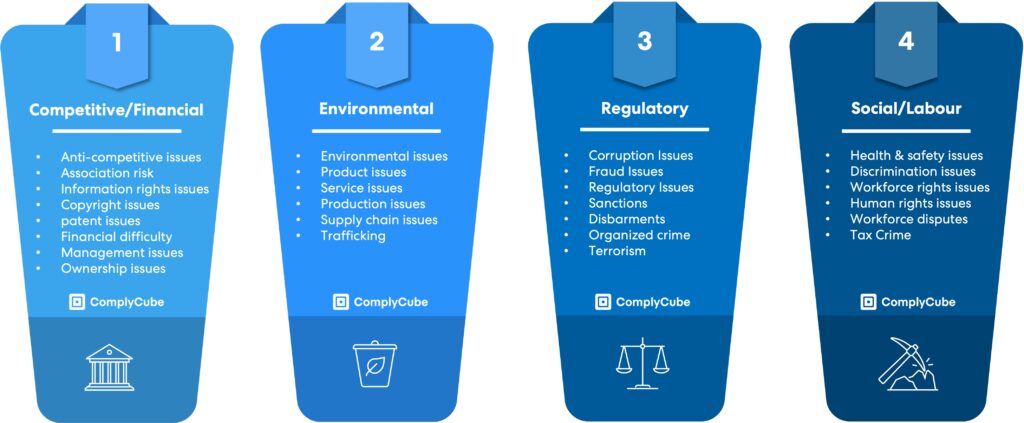

At ComplyCube, we use the following buckets to categorize Adverse Media:

Where does Adverse Media come from?

- Traditional news outlets and Media.

- International Organisation’s databases.

- Blogs and web articles.

- Specialized websites that publish issues involving AML and FinCrime.

- Social media and internet forums.

- Press releases and notices published by regulators, law enforcement agencies, tax authorities, and other government agencies.

What do regulators say about Adverse Media?

It is no surprise that different jurisdictions and regulators enforce various Adverse Media AML regulations and guidance. However, they all highlight the need to build accurate risk profiles of clients.

Financial Action Task Force (FATF) recommends “verifiable Adverse Media searches” as part of customer risk assessments and underlines the need to “understand the client’s reputation”. It also requires firms to determine whether high-risk clients have been “previously investigated” for money laundering or terrorist financing or subject to regulatory enforcement in the past.

Similarly, the EU’s 4th Anti Money Laundering Directive (4MLD), also transposed into UK law, requires firms to perform enhanced customer due diligence (CDD) for high-risk customers, leveraging open-source or Adverse Media searches. 4MLD was strengthened by 5MLD on 10 January 2020 with the new directive encouraging automated Adverse Media Screening. On 3 December 2020, 6MLD came into effect, adding cybercrime and environmental crime to the list of money laundering predicate crimes and extending the AML criminal liability.

Following Brexit, the UK has opted out of the 6MLD, on the basis that domestic legislation already ‘goes much further’. However, any regulated UK businesses operating in Europe must comply with the 6MLD.

The United States Financial Crimes Enforcement Network (FinCEN) requires financial institutions to conduct Adverse Media Screening as part of the CDD process. FinCEN also requires a risk-based AML approach that includes Adverse Media Screening throughout the relationship, in other words, ongoing Adverse Media Checks.

The Challenge of Adverse Media Screening

Manual Adverse Media Screening is time-consuming, highly ineffective, and does not scale. For instance:

- Institutions use internet searches and “googling” news articles to perform manual searches for negative news on high-risk clients.

- The outcome of these searches needs to be crossed-referenced with other data sources and ultimately must be approved by Compliance Officers.

- This manual process is labor-intensive, costly, highly error-prone, and subject to increased human bias.

- Media coverage is changing at a staggering pace. Therefore, manual searches provide only a static risk snapshot.

- Media coverage may not be available in a familiar or accessible language and thus may be misunderstood.

- Limited access to some sources will lead to a few pieces of Adverse Media going unnoticed.

How our automated processes will help you?

In today’s media landscape, a process reliant on manual searches cannot contend with automated systems that digest enormous amounts of data in real-time, validate it, and then send notifications as soon as there is something of interest.

As such, systematic Adverse Media checks provide you with a more in-depth insight into your clients and allow you to tailor searches based on your risk approach and regulatory requirements. With state-of-the-art systems such as ComplyCube, you will be able to screen customers across a vast array of databases and news sources whilst receiving only risk-relevant results. Our leading platform will enable you to protect your company from reputational, and AML risks effortlessly and cost-effectively.

Check out www.complycube.com to learn more about our platform.