The rapid growth of the online economy and the FinTech industry has led to an unprecedented demand for Anti-Money Laundering (AML) and Know-Your-Customer (KYC) tools. What do we mean by AML and KYC? Can we use these two terms interchangeably? To understand the difference between KYC vs AML, we’ll start by looking at what each process implies.

What is Know Your Customer (KYC)?

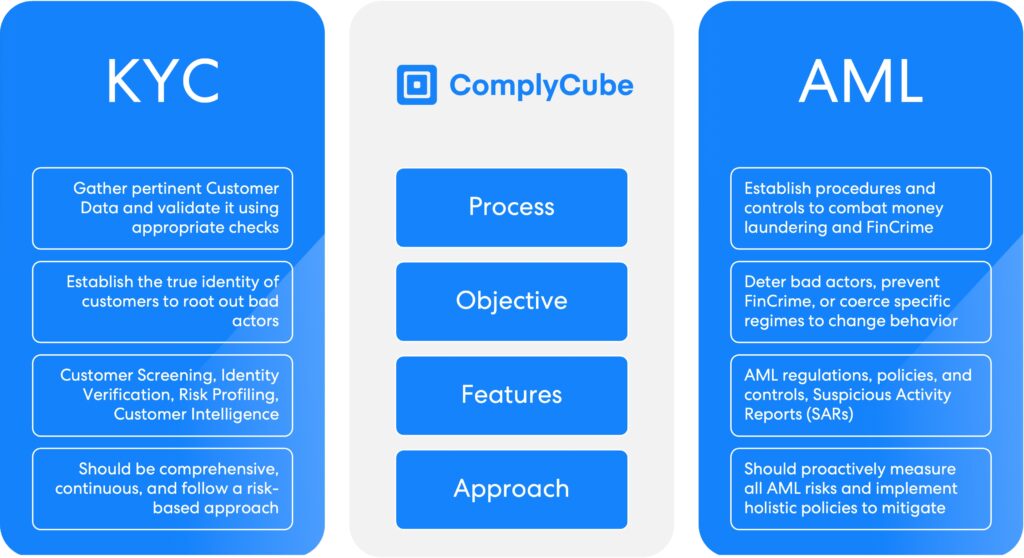

KYC is the process financial institutions follow to collect relevant data from their customers to establish their identity and risk profile. For instance, investors must be verified before participating in a funding round, and likewise, individuals must be verified before opening a bank account. Anti-money laundering (AML) regulations require KYC for regulated firms to ensure that they do not conduct business with malicious individuals and contribute towards terrorist financing.

What is Anti-money laundering (AML)?

AML refers to measures, policies, and controls regulated institutions and governments employ to prevent, discourage, and combat Financial Crime (FinCrime), especially money laundering and terrorism financing. AML also encompasses Sanctions, which governments or international bodies use to coerce specific regimes to change their behavior. Moreover, a regulated institution’s AML policy forms part of its broader AML compliance program, which is developed to comply with its local AML regulatory requirements.

What is a Customer Identification Program (CIP)?

Businesses undertake a Customer Identification Program (CIP) to learn more about a customer’s identity when onboarding new consumers. It is the first step in stopping financial crimes. CIPs help businesses identify customers so they can conduct further regulatory checks on them, such as AML screening. Learn more by reading “What is CIP?“

What is Customer Due Diligence (CDD)?

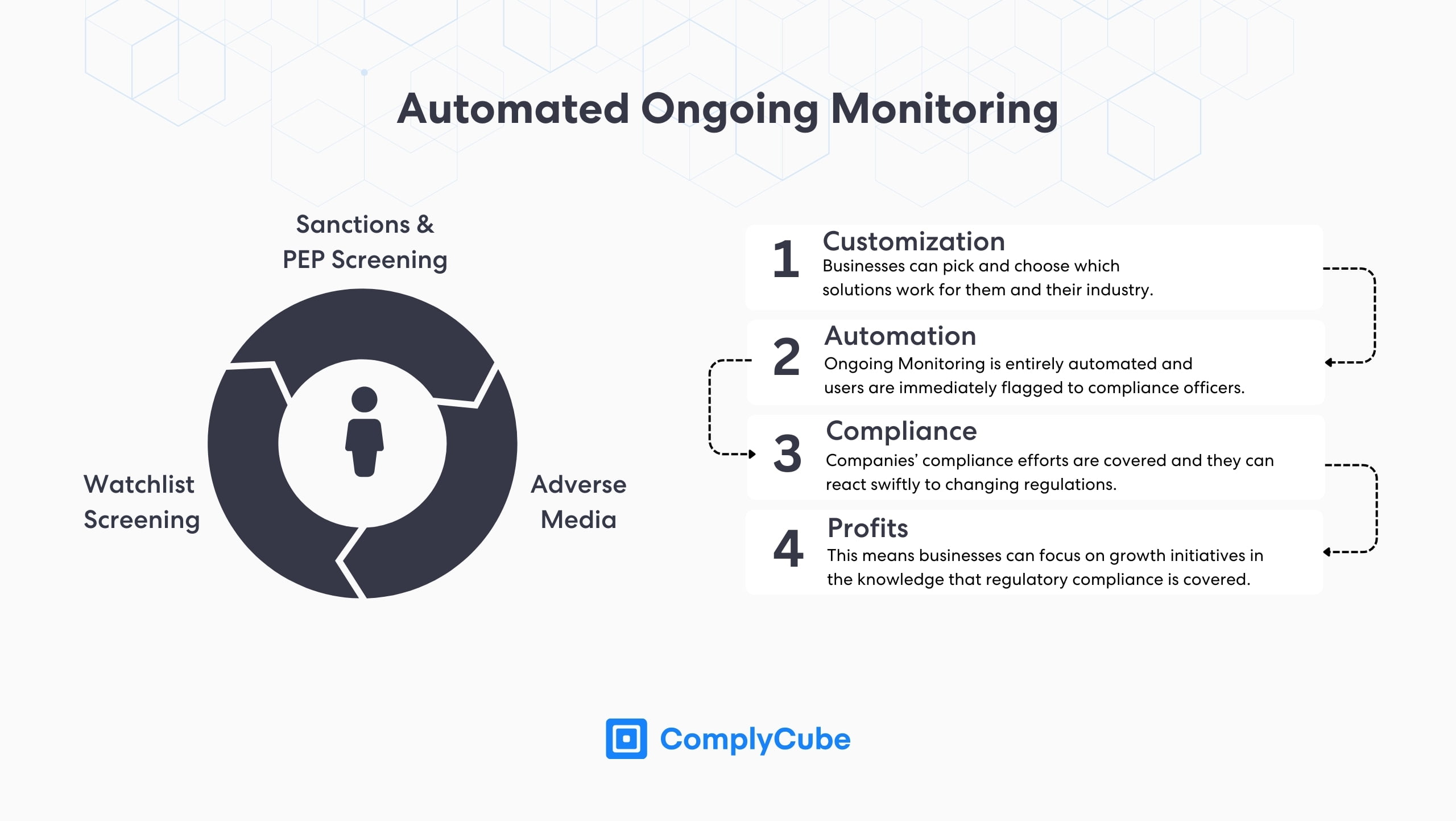

AML and KYC regulations state that once a firm has identified a client, it must conduct Customer Due Diligence to ascertain the level of associated risk posed. CDD involves further identity checks and background and AML screening, amongst other tasks.

Enhanced Due Diligence (EDD) is occasionally needed for higher-risk individuals, such as Politically Exposed Persons (PEPs). To help prevent money laundering, these processes are conducted around the clock in what is known as ongoing monitoring. Learn more by reading What is Customer Due Diligence?

How do KYC and AML differ?

Though institutions may blur the lines between KYC and AML, they are two distinct compliance frameworks. They have different scopes, processes, and objectives, as depicted in the comparison graphic below. AML is much broader in scope and typically encompasses many components, such as:

- KYC procedures.

- AML standards and guidelines.

- Risk-based AML policies.

- AML staff handbooks.

- Ongoing risk assessment and continuous monitoring.

- AML compliance training program for staff.

- Internal controls and internal audits.

- Escalation matrices and procedures.

With that said, an effective AML policy requires a reliable KYC process, as without establishing customers’ true identity and their source of funds, FinCrime cannot be prevented or detected. On the other hand, AML laws and policies inform the risk-based approach that needs to be followed for KYC procedures.

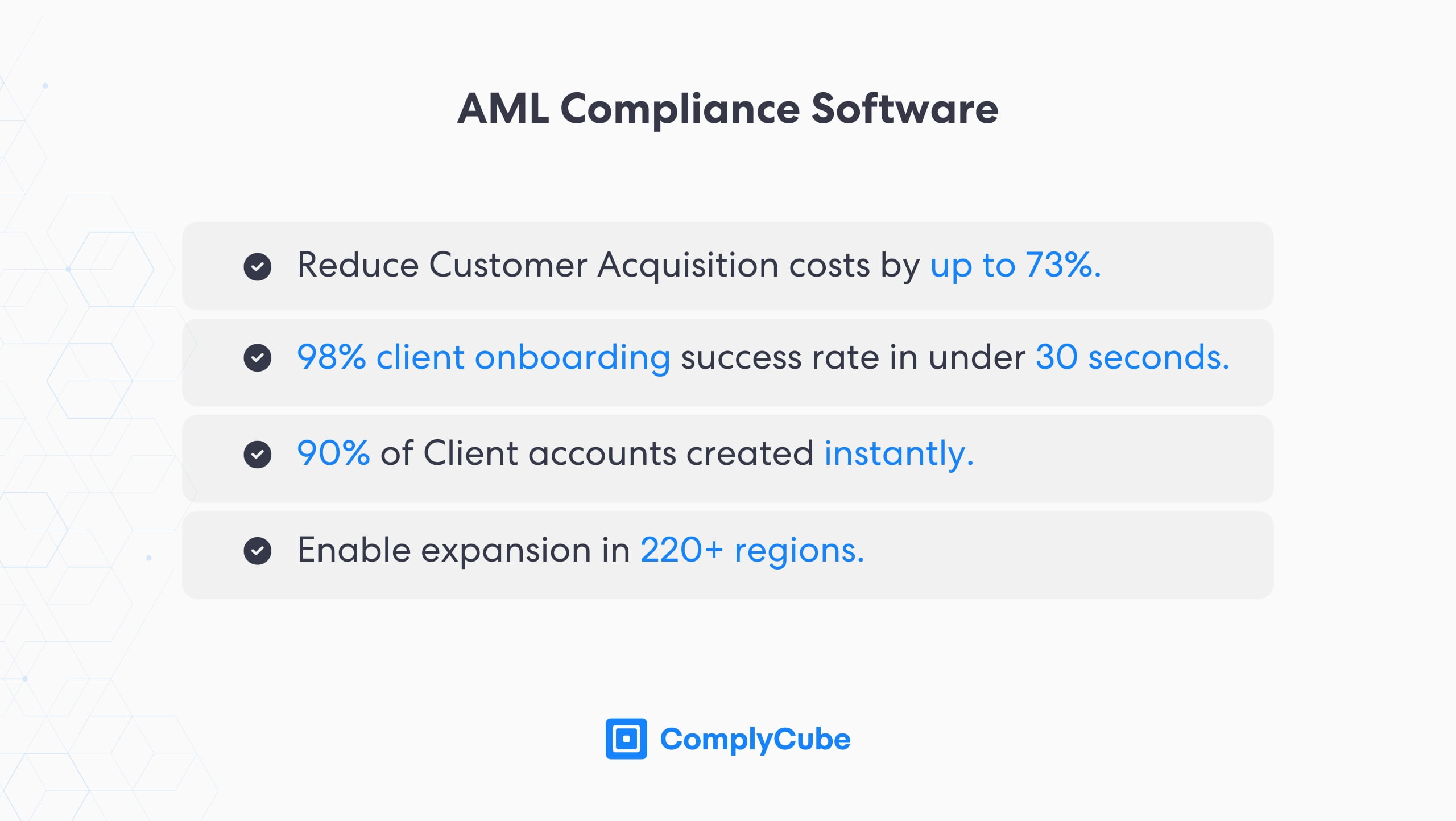

AML vs KYC Compliance Solutions

Achieving compliance with AML/CFT regulations requires significant administrative effort and large amounts of data analysis. Hence, many firms opt for automating AML processes with various innovative tools to reduce human error and avoid potential compliance penalties. Automation not only offers improved speed, accuracy, and efficiency to AML; it also helps firms quickly respond to new regulations and continue to deliver the highest standards of compliance.

For instance, AML solutions can quickly analyze customer data, look for specific risk flags, and raise real-time alerts to Money Laundering Reporting Officers (MLROs). They also help with the automation of KYC procedures through electronic Identity Verification (eIDV), which typically involves the following two steps:

- Acquisition of an identity document, e.g., passport, national identity card, or driver’s license. The ID document is then analyzed across multiple vectors such as authenticity, consistency, expiry, and so forth.

- Establishing that the document holder is indeed present during the transaction. This is achieved by taking a selfie or video along with a passive or active liveness check.

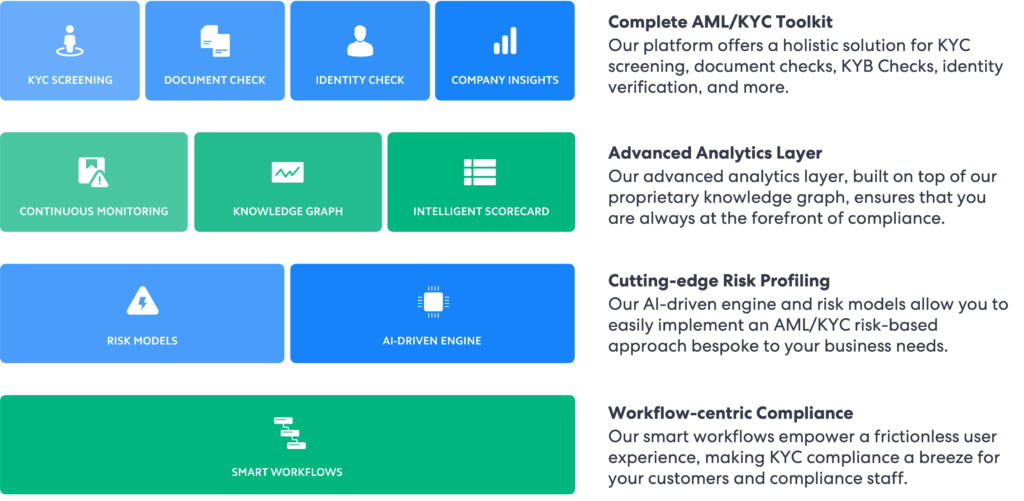

At ComplyCube, we have built a powerful AML/KYC Compliance stack on top of smart workflows and APIs. Our unique platform enables firms to quickly implement a risk-based AML/KYC framework bespoke to their needs. Businesses can also leverage our state-of-the-art Mobile and Web SDKs to create user-friendly KYC processes that effortlessly verify customers’ identities.

For more information on how to safeguard your organization, get in touch with our expert compliance team.