Worldwide PEP Checks

Extensive PEP Screening

Identify politically exposed persons including members of parliament, public company directors & their relations.

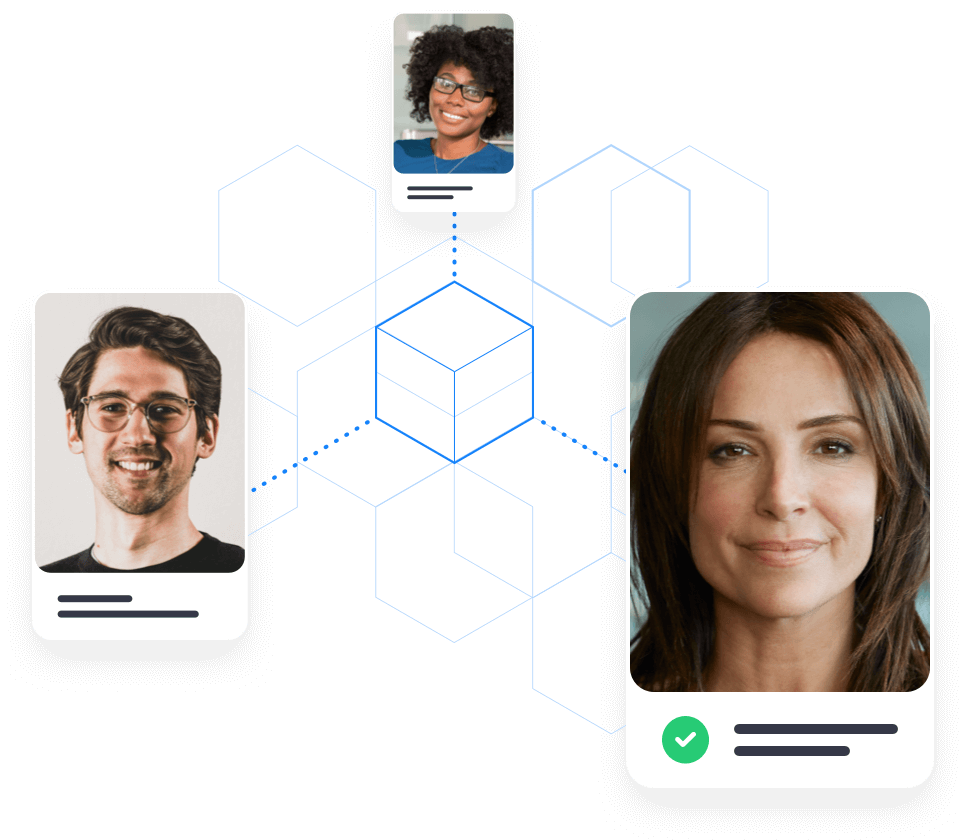

Intuitive workflow

Seamlessly integrate our rich breakdowns with your KYC processes, review potential matches, and improve your identity verification framework with:

- Structured profiles

- A vast database

- Linkages to associates and relatives