Trust Node Level 1

Crypto AML Coverage

Reduce costs of acquisition and mitigate fraud in real-time with Trust Node Level 1’s complete suite of Know Your Customer tools. Our flexible KYC package includes:

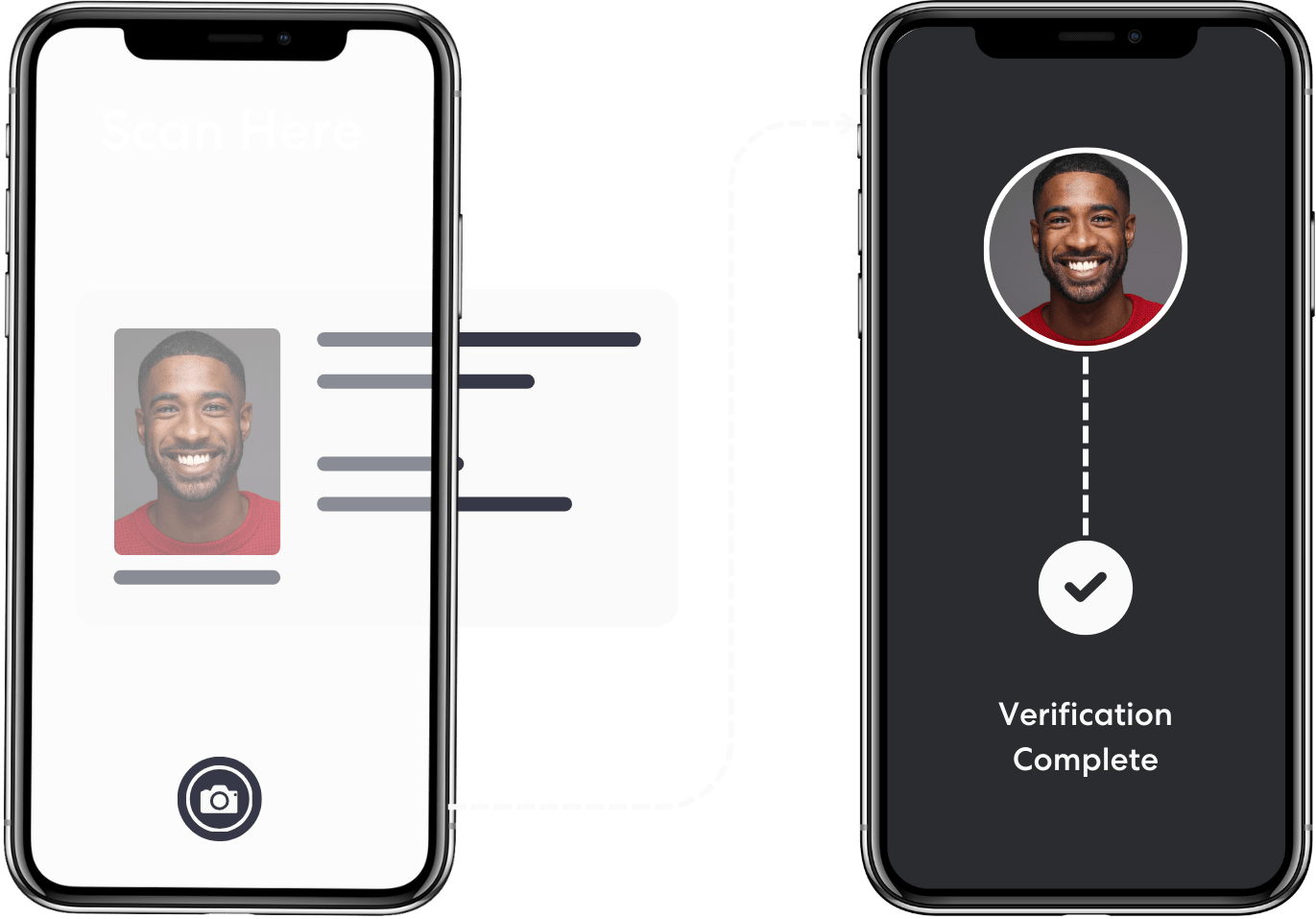

Identity verification flows

Ongoing Monitoring

AML screening

Proof of Address Verification

User Risk Scoring

KYB verification