Global Identity Verification

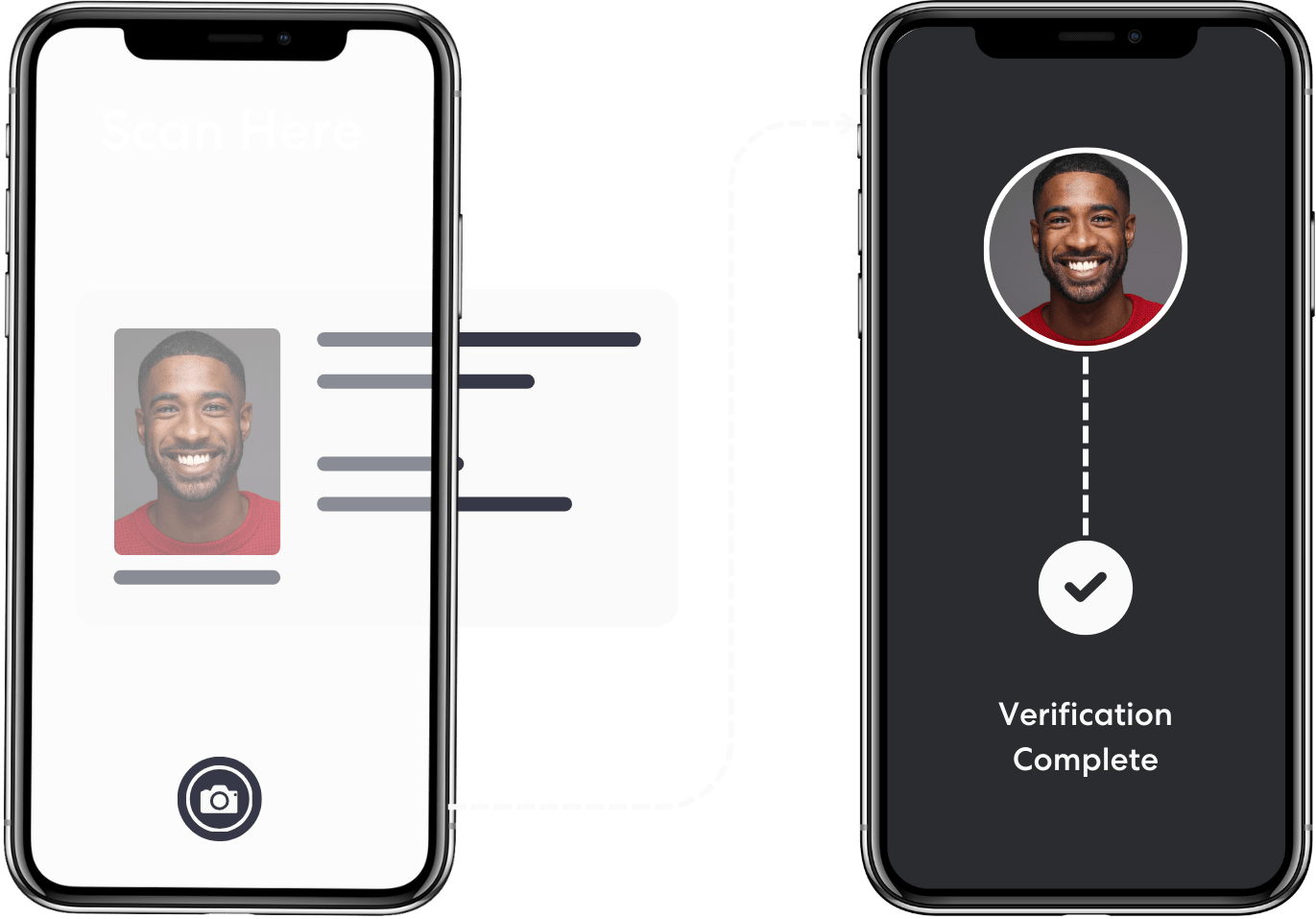

Automated IDV Flows

Using AI-powered verification engines, we instantly analyze and match a document with a selfie to check for similarities.

Our automated and easy-to-follow user experience means users are verified in under 30 seconds and can begin depositing.

Immediate verification

Reliable results

Prevent churn